Interested in this kind of news?

Receive them directly in your inbox. Delivered once a week.

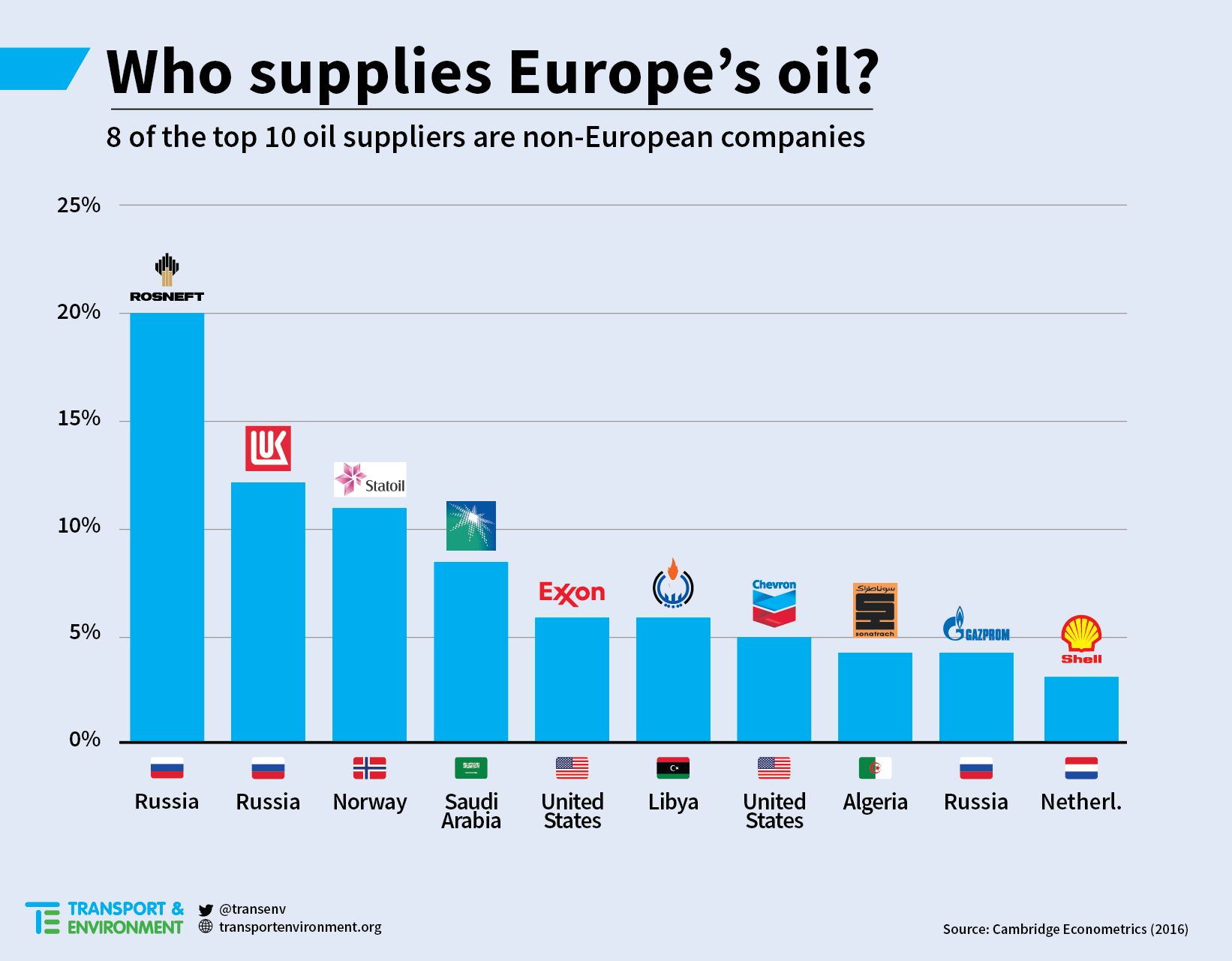

The companies benefiting most from EU crude oil imports are Rosneft and Lukoil which together receive around a third of the revenues. Statoil and Saudi Aramco together take another 20%. Overall, non-European companies supply 80% of EU oil imports. The dependence on geopolitically risky countries, notably Russia, has also increased. The ‘Visegrad’ countries (Poland, Slovakia, Hungary, and the Czech Republic) plus Greece have a particularly high risk of disruption of their oil imports.

Two-thirds of final demand for oil is for transport. Reducing energy insecurity requires transport oil consumption to be reduced and a robust and ambitious framework to decarbonise transport will make a significant contribution to this. The upcoming European Strategy for Low Emissions Mobility can make a significant contribution towards this. Effective policies for this Strategy include CO2 standards for cars, vans and trucks in 2025; an integrated strategy to accelerate the electrification of transport that embraces mobility needs; the potential of emobility balancing smart, renewable grids; and an industrial policy that supports the shift to electric vehicles; and for the EU to go beyond global action in tackling CO2 emissions and oil use of aviation and shipping.