T&E has published an addendum that updates the 2022 publication Addressing the heavy-duty climate problem to take into account the European Commission’s proposal on the review of the CO2 standards for heavy-duty vehicles (HDVs), which was published in February 2023. The analysis shows the impact of the Commission proposal on the emissions trajectory towards 2030, 2040 and 2050, as well as on energy consumption (oil, electricity and hydrogen) and the EU’s carbon budget. It then compares the Commission proposal with current policies and more ambitious targets for the HDV CO2 standards as proposed by T&E.

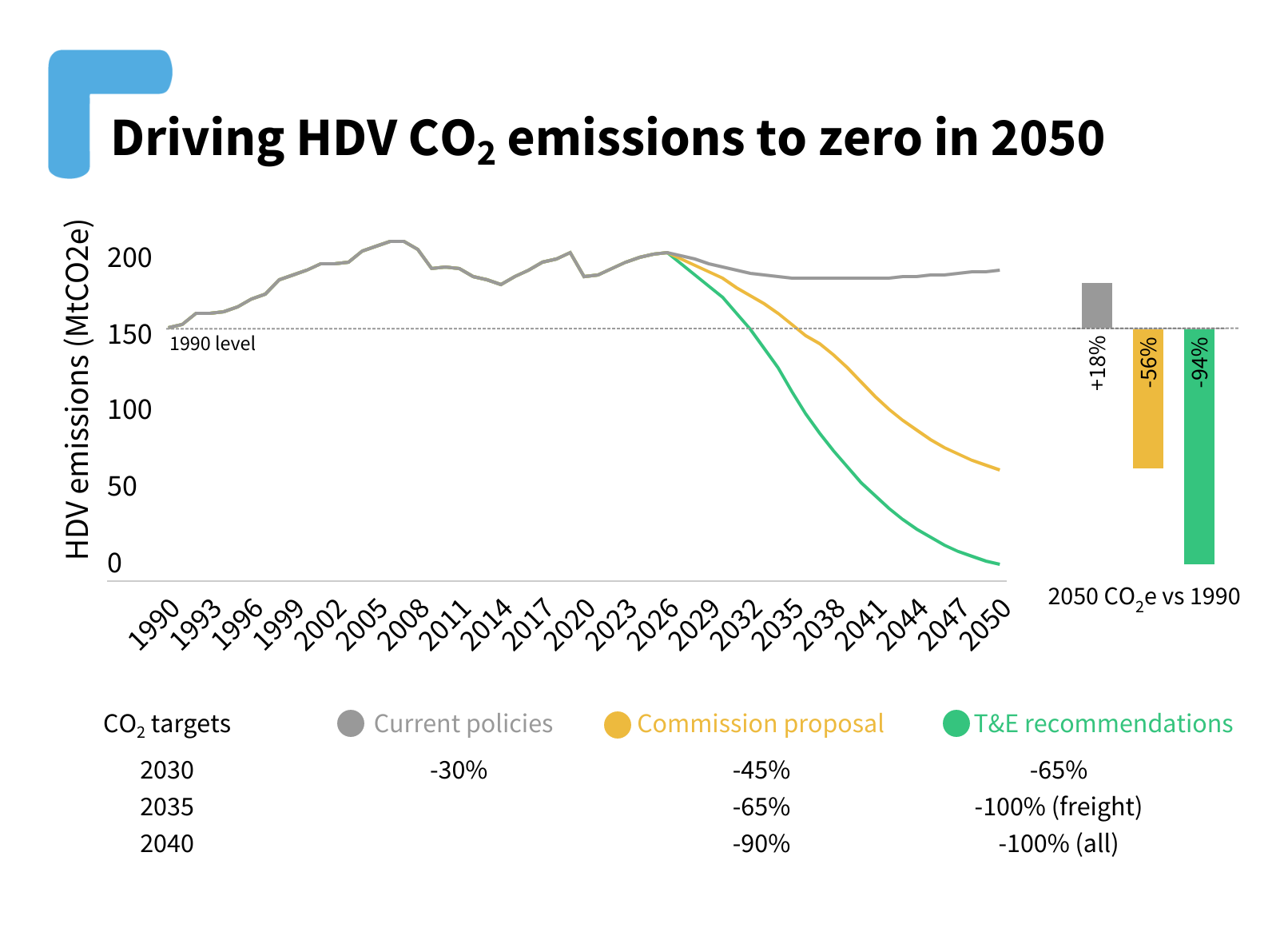

Emissions from trucks and buses have increased by 28% between 1990 and 2019. Considering current policies and without additional measures, HDVs are projected to eat up 60.9% of the EU’s remaining carbon budget for a 1.5°C world. By 2030, we would be faced with a 3.8% increase in oil consumption from HDVs due to continued activity increase of HDVs.

The Commission’s proposal aims to tackle Europe’s heavy-duty climate problem. However, this analysis finds that their proposed CO2 targets for HDVs are far from sufficient to deliver on the EU’s climate targets. While the EU Climate Law commits to a fully decarbonised economy by 2050, the proposal would only deliver a -56% cut in emissions from HDVs by that date (compared to 1990). 40% of the diesel fleet would still be on the road after 2050, with these trucks being 7 to 8 years away from the EU’s average truck retirement age. On top of that, the Commission proposal is allowing a continued sale of new diesel trucks even after 2050 by failing to set a 100% zero-emission sales deadline, as well as by exempting almost 20% of HDV sales from the reduction targets of the regulation.

T&E’s recommended targets on the other hand would deliver a -94% CO2 reduction by 2050, with the remaining diesel fleet very close to retirement age.

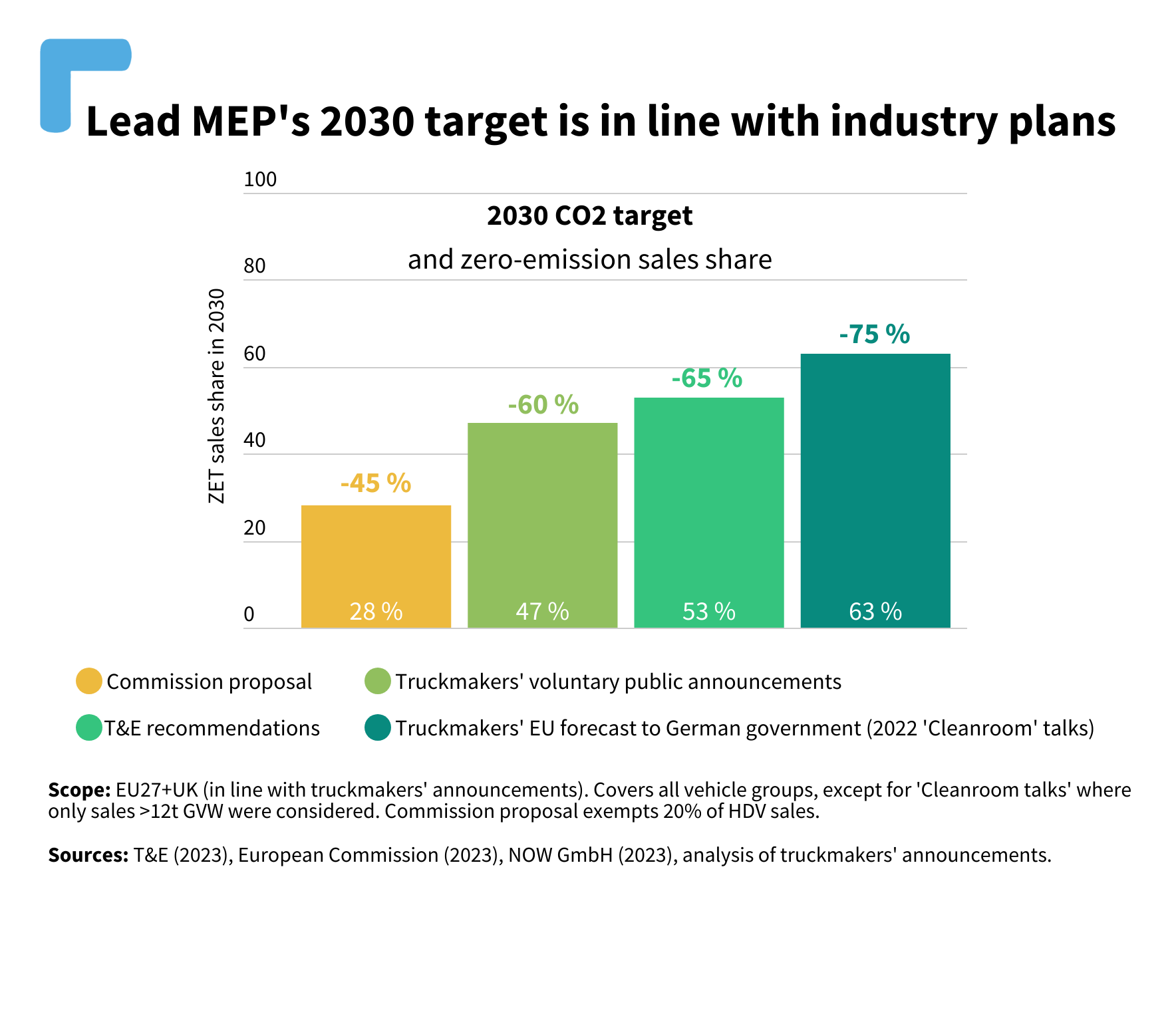

2030 target behind even voluntary industry commitments

Six of the EU’s seven major truckmakers have made public announcements about the share of new sales being zero-emission by 2030. Aggregating those announcements, 47% of new EU truck sales (or 9% of the total fleet size) would be battery electric (BEV) or hydrogen fuel cell (FCEV) in 2030. In private conversations with the German government, the so-called ‘Cleanroom talks’, manufacturers have projected an even higher uptake of 63% zero-emission sales by 2030. T&E therefore recommends increasing the 2030 CO2 target under the HDV CO2 standards from the Commission proposal of -45% to -65%. This would be aligned with the industry’s own voluntary commitments and projections.

Infrastructure and energy consumption

Charging and refuelling infrastructure is often cited as the main obstacle for an obligation on truck manufacturers to ramp-up zero-emissions truck and bus sales more quickly. However, our analysis finds that the expected public infrastructure under the Alternative Fuels Infrastructure Regulation (AFIR) will provide enough infrastructure for a more ambitious -65% target in 2030.

A big advantage of zero-emission vehicles is also that they are far more energy efficient than diesel trucks. With HDV activity projected to increase by 34% between 2019 and 2050, the sector urgently needs to get off its oil addiction. Total energy consumption (across oil, electricity and hydrogen) could fall by 37% in the 2019-2050 timespan under T&E’s recommended targets, while the Commission’s proposal only achieves a -24% reduction.