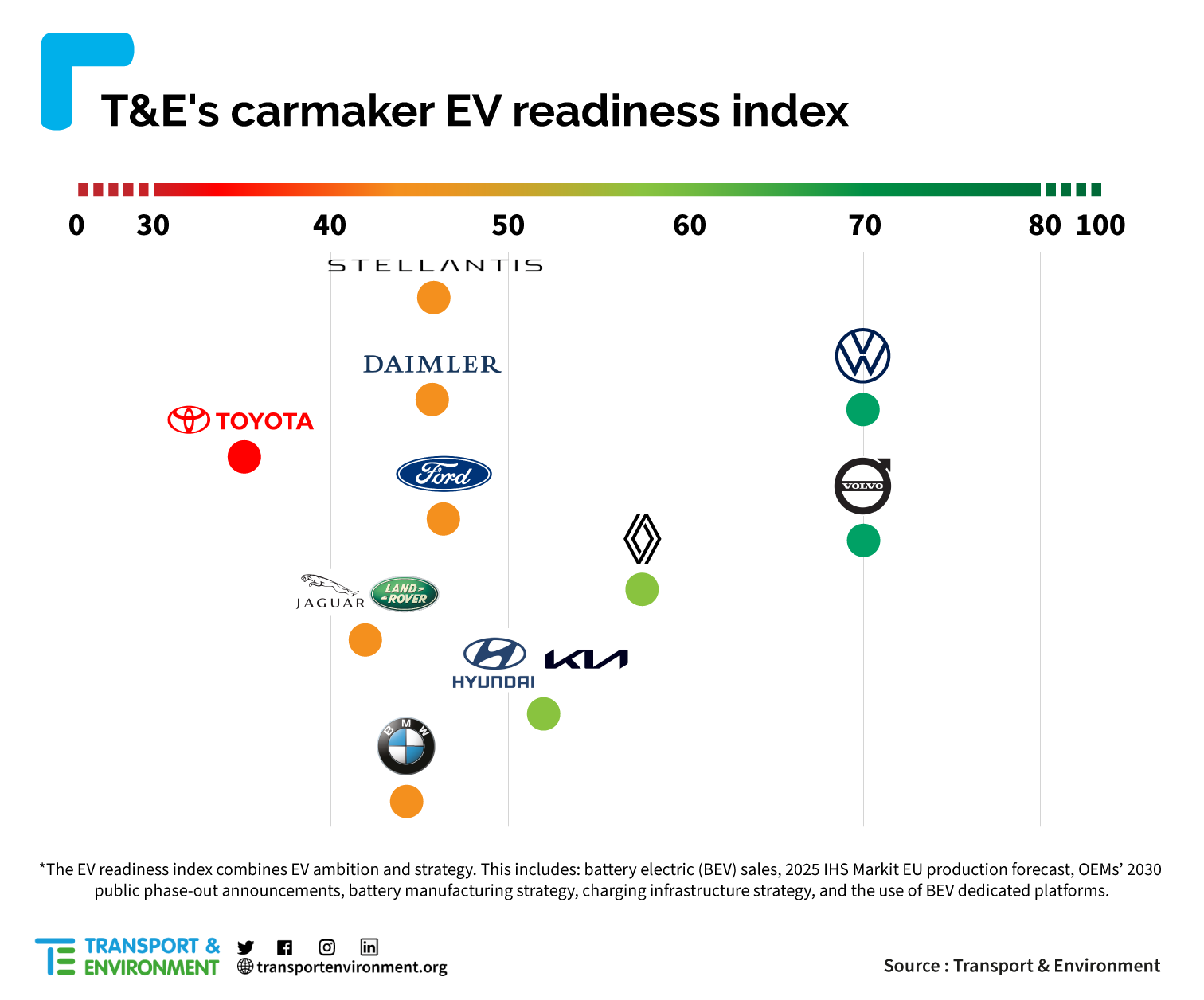

T&E’s ranking of the readiness of 10 major OEMs in Europe to transition to electric by 2030 [1], shows there are big differences in ambition and quality of their plans. Volkswagen and Volvo Cars have aggressive and credible strategies. Others like Ford have an ambitious phase-out target but lack a robust plan to get there. Stellantis, Daimler, BMW, Jaguar Land Rover, and Toyota rank the worst with low short-term battery electric (BEV) sales, no ambitious phase-out targets, no clear industrial strategy, and an over-reliance in the case of BMW, Daimler and Toyota on hybrids.

Julia Poliscanova, senior director for vehicles and emobility, said: “Carmakers are desperate to show off their green credentials, but the reality is most of them are miles away from where they need to be. Even those that are ambitious lack a suitable strategy to get there. Carmakers have failed to deliver on their promises before, who says this time will be different?”

The report also reveals:

- BEV production in the EU27 is expected to increase from around 1 million units in 2021 (7.4% of production), to 3.3 million units in 2025 (24.2%) and surpass sales of cars with an internal combustion engine (ICE) in 2030 with 6.7 million (50.2%).

- Carmakers’ production plans show that plug-in hybrid vehicles (PHEVs) are expected to peak at 1.6 million units in 2026 (12% of total car production) and then stagnate throughout the second half of the decade.

- Ford has an ambitious commitment to become fully electric by 2030. But it appears to be running out of time. It is expected to produce just 13% BEVs by 2025.

- Toyota has not set a target for 2030 and it plans to produce just 10% BEVs in 2025. It is expected to rely on polluting hybrid technologies (44% of its EU production in 2030).

The report raises concerns over the reliance on carmakers’ voluntary commitments, which are too low and not backed up by a coherent industrial strategy. Previous analysis by T&E showed that in 2016, carmakers failed on their collective target of selling 3.6% electric cars, achieving less than half of that.

But even if the current promises are met, Europe’s sales of battery electric vehicles (BEVs) are likely to be at least 10 percentage points lower than they need to be in 2030. To ensure carmakers ramp up the production of affordable electric cars in time to decarbonise by mid-century, European regulators need to set binding car CO2 targets in the next decade leading to two-thirds of new cars being fully electric by 2030 and all new cars in 2035, says T&E.

Julia Poliscanova concluded: “There is no longer any doubt that a fossil fuel free, all electric future is possible. But with only two carmakers close to where Europe needs to go, policymakers can’t leave it to carmakers to get there on their own. Targets need to be gradually tightened so that carmakers not only commit to phasing out fossil fuels, but develop a strategy that gets them there on time.”

Recommendations:

- A higher 2025 standard of -25% and an additional target of at least -40% in 2027 are needed to make electric cars affordable, and the EU car industry globally competitive.

- A 2030 target of at least -65%, followed by a complete phase-out of combustion engine vehicles in 2035.

- No multipliers or credits for current PHEV models, whose CO2 values should be adjusted based on their real-world emissions.

- No fuels credits and tightening of existing regulatory loopholes such as mass adjustment.

Notes to editor

[1] T&E’s EV readiness index looks at carmakers’ current and short-term EV sales, as well as their wider industrial strategies (battery supply chain, charging infrastructure, dedicated BEV platforms etc.).

Includes content supplied by IHS Markit Automotive; Copyright © Global Light Vehicle Production based Powertrain Forecast, April 2021. All rights reserved; IHS Markit is a global market leader of independent industry information. The permission to use IHS Markit copyrighted reports, data and information does not constitute an endorsement by IHS Markit of the manner, format, context, content, conclusion, opinion or viewpoint in which IHS Markit reports, data and information or its derivations are used or referenced herein.

Read more: