Profits of Europe’s major leasing companies have grown by 59% from 2018 to 2022 even though their fleet sizes only grew by 5%.[1] A new report by research organisation Profundo and commissioned by T&E looks at the profitability of Europe’s seven largest leasing companies (ALD | LeasePlan, Alphabet/BMW Financial Services, Arval, Leasys, Mercedes-Benz Mobility/Athlon, Mobilize Financial Services, and Volkswagen Financial Services)[2] and finds that it reached a combined €15.7 billion in 2022.

Given these high profits, leasing companies have the financial power to change course and accelerate their transition to electric cars. T&E research has shown that the leasing sector is not leading the EU market on electrification and none of the leasing companies analysed in this report has set a phase-out date for polluting cars.

The two leasing companies that recorded the biggest growth in profit since 2018 are Arval (owned by BNP Paribas) and Leasys (the leasing branch of Crédit Agricole and Stellantis). Arval’s profits grew by 192% since 2018, although the number of leased and financed vehicles only rose by 33%. Leasys’s fleet size increased substantially (82%) but its profits nearly doubled that (143%).[3]

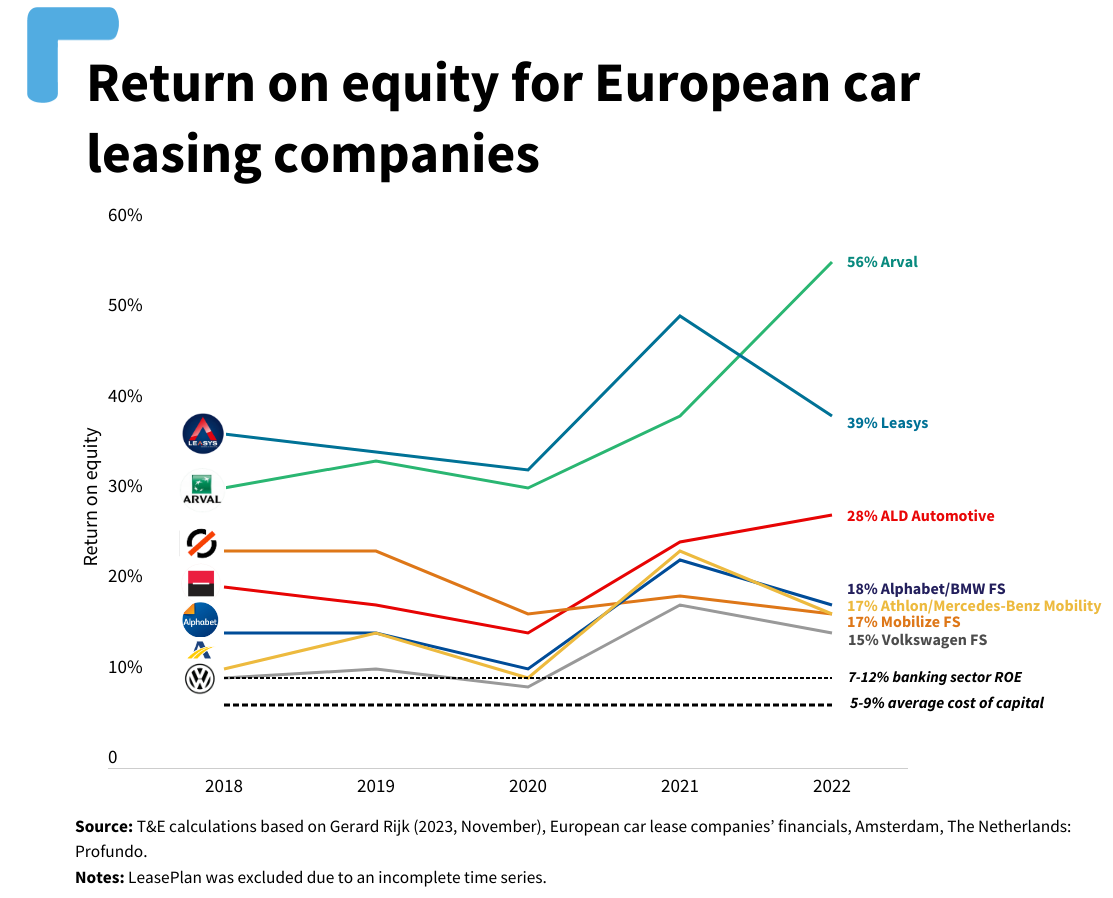

The average ROE for the leasing companies has increased from an already high 21.2% in 2018 to 27.2% in 2022. ROE is the benchmark used by investors to determine the financial health of a company. For comparison, banks – the owners of some of the largest leasing companies and a comparable sector – record a ROE between 7-12%.

Stef Cornelis, director electric fleets programme at T&E explains: “Leasing companies record billions in profit, yet they are not driving the transition to electric. This mismatch between the profitability of major leasing companies and their progress on electromobility is becoming almost awkward. Their strong financial performance would easily allow them to invest in more electric vehicles – yet it seems they are more preoccupied with profits and cash.”

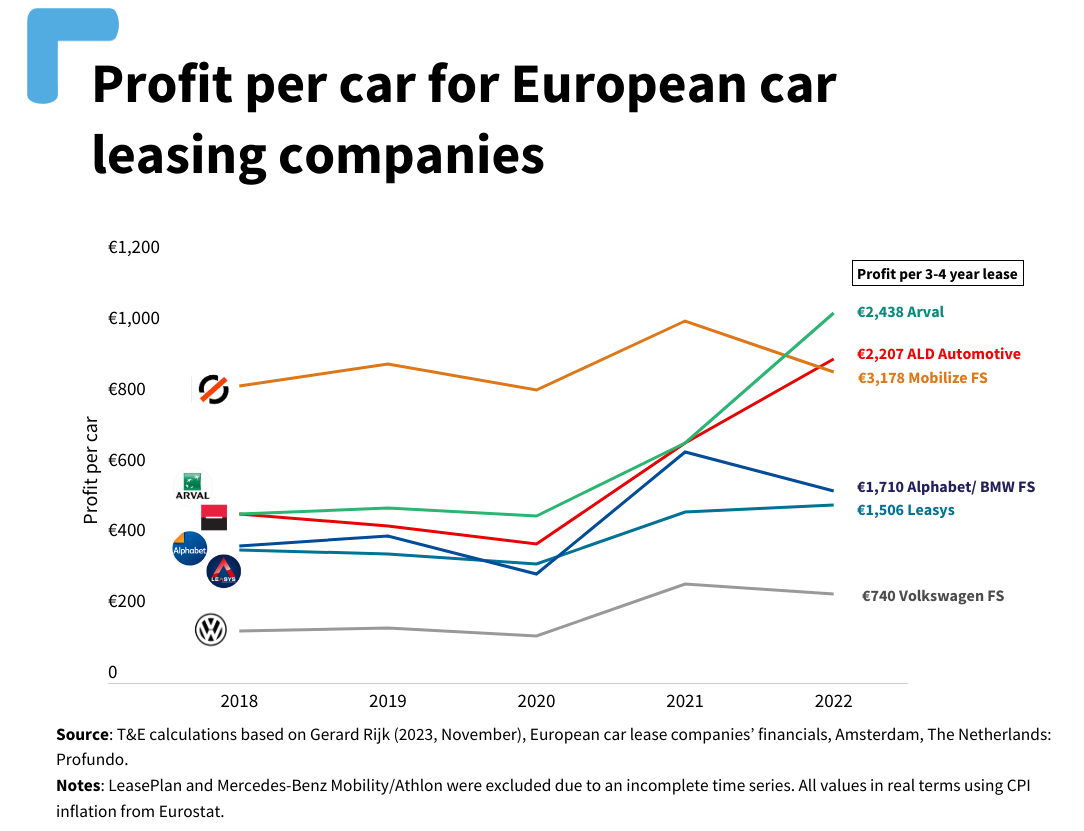

Higher profits per car

The report indeed finds that on average the profit per car has risen by 53% from 2018 to 2022 for the selected leasing companies, meaning customers are paying much more than four years ago. Indeed, the fleet sizes of leasing companies have only increased by 5% in the last few years.

All companies showed strong increases, except for Mobilize. Over a 3.5-year lease period, Arval’s profit per car is close to €2,400 and Mobilize is €3,200. A typical car, such as an Opel Corsa or Peugeot 208, costs around €12,000-15,000 to lease over its leasing period. These profits are being made off monthly lease deals and from the reselling of cars on the second-hand market, where most families in the EU buy their cars.

“With their ballooning profits, leasing companies are clearly doing good business. But someone is paying for this profit – whether the leasing customer or second-hand buyers. If the profit per car is increasing, leasing companies are making more money off the back of their customers.” Stef Cornelis concludes.

[1]The 82.3% pre-tax profit growth has been adjusted for CPI inflation using 2019: 1.47%, 2020: 0.74%, 2021: 2.9%, and 2022 9.19% based on Eurostat.

[2] In 2022, ALD Automotive and LeasePlan had not yet merged and were still separate financial entities. They were considered separate in this report. Since then, the two companies have formed an entity called Ayvens.

[3] The 235% pre-tax profit growth for Arval and 179% for Leasys have been adjusted for CPI inflation using 2019: 1.47%, 2020: 0.74%, 2021: 2.9%, and 2022 9.19% based on Eurostat.