On October 25th 2022, the Italian oil major Eni announced with great fanfare that it had delivered on an official promise made to its shareholders in 2020, to eliminate the use of palm oil in its refineries.

A press release from that day states that “Eni has definitively ended the procurement of palm oil for use at the Venice and Gela biorefineries” and that “the last shipments arrived in the last few weeks, ahead of the declared goal of becoming ‘palm oil free’ by the end of 2022.”

The announcement followed decades of increased public awareness on the detrimental impacts of palm oil for so called ‘biofuel’ production in Europe, followed by a decision by the EU to reduce its use from 2023 to reach zero in 2030.

The Italian company’s pledge was also part of a wider move by oil majors to try to address criticism over the harmful impact of their intensive use of palm oil in fuel production – which ended up causing more harm to the climate than the oil it was aimed to replace. French oil company Total Energies notably made a similar pledge in 2021.

Three shades of palm

The detailed statements and information provided by Eni in its official reports since 2020 regarding its pledge to phase out palm oil are way less straightforward than the narrative used in its 2022 press release. As the following analysis suggests, the company has first emphasized that it would phase out crude palm oil alongside one of its main derivatives, PFAD, while being later on quite unclear about the exact feedstocks which were actually replacing crude palm oil.

It seems that the first mention of the company’s intention to ditch the deforestation-causing product appeared within its presentation of its “Long-Term Strategic Plan to 2050 and Action Plan 2020-2023” on 28th February 2020. On this occasion, the company specified that its “bioprocessing capacity” will be “palm oil free by 2023”. It also said that it aimed to pursue, in the medium run, an ‘expansion of bio-refining capacity (…) supplied exclusively with 2nd and 3rd generation palm oil free feedstocks”.

Then, in May 2020, when asked prior to its General Assembly and in reference to its pledge, about the expected use of palm oil and its derivatives (…) by 2023, the company responded that : “As part of its decarbonisation strategy, Eni is substantially reviewing the supply chain in order to bring the use of palm oil and PFAD down to zero by 2023’.

Eni further clarified in a response to a different question before its 2020 AGM that both crude palm oil and PFAD were concerned by its pledge : ‘In 2023, Eni will bring down to zero the production of biofuels from palm oil and PFAD.’

When Eni pledged to ditch PFAD, it however left the room open for use of Palm oil mill effluent (POME), which are wash-water generated through palm oil milling.

Palm fatty acid distillates (PFAD) are a “lower quality palm oil derivative ” that come out of crude palm oil production, according to Dr Chris Malins, expert in ‘clean fuels’ policy at consultancy Cerulogy . According to him, PFAD are used “instead of palm oil in applications where quality is less important”, such as biofuel production.

PFAD’s use in biofuels has been under scrutiny due to competition with existing uses, notably as animal feed and raw material for soap and oleochemical products, which can lead to displacement effects and increase the use of crude palm oil elsewhere.

The accounting of the greenhouse gas emissions emissions of PFAD very much depends on whether it is classified as a co-product, by-product or residue of palm oil production- and whether ‘upstream’ emissions associated with palm oil plantation should be taken into account. While there is no consensus on the classification in the scientific literature, many scientific articles classify PFAD as being one of the primary products from the crude palm oil production process, in which case their climate impact is not better than that of crude palm oil.

Oil companies and biofuel manufacturers typically consider PFAD as ‘waste and residue’, in order to leave out upstream emissions from the accounting of the climate impact of PFAD.

In response to our questions, Eni also stated that ‘the use of a waste byproduct such as PFAD is a consequence – not a cause – of palm oil production’ and that ‘{they} disagree with equating the use of such as waste product with the use of palm oil itself.’

New research published by Dr Chris Malins for the Rainforest Foundation Norway refutes those claims. Reviewing the market for PFAD and taking into account their price and alternative uses, the report considers that “Characterising PFAD as a waste or low-value residue would certainly not be accurate“. This new piece of research has estimated that, taking into account substitutions effects, the emissions of PFAD biofuels can reach up to 230 gCO2e/MJ in the worst case, more than twice the emissions of fossil diesel, and quite close from the emissions of palm oil biofuels (285 gCO2e/MJ). In the best case, they average at 100 gCO2e/MJ, still worse than ‘classic’ diesel made from fossil fuel.

EU biofuels regulation does not classify PFAD biofuels as ‘advanced biofuels’, which receive preferential support under the EU’s Renewable Energy Directive. Although countries can provide policy support for PFAD biofuels, some have fully removed their policy support to it or have classified PFAD as a by-product, de facto making it more difficult to use it. PFAD have also been excluded from the recently adopted EU’s aviation fuel policyies targets (ReFuel EU).

Concluding on the climate impact of PFAD, Dr Chris Mallins states that “If that resource is diverted to biofuel production, it means palm oil will be needed for those applications, and that extra palm oil demand causes deforestation”.

In any case, Eni has put a strong emphasis in its communication on replacing crude palm oil with only “sustainable raw materials”. In 2022, when communicating on the reach of its pledge, Eni emphasized that its refineries had switched to ‘waste & residue’ raw materials”, quoting “used cooking oil and animal fats” but not PFAD.

In other official reports, the company made reference to using other feedstocks such as “used cooking and frying oils, animal fats and vegetable oil processing waste” or broad categories such as “advanced feedstocks (e.g. lignocellulosic material and bio-oils)” making it hard to identify which feedstocks are being used to replace crude palm oil.

The only reference to the ongoing use of PFAD – which seems to contradict Eni’s previous statements – can be found within the Gela refinery 2022 sustainability report which states that “the target of zero palm oil was reached, replaced in part by a 300% increase in processing of Renewable/Recycled Used Cooking Oil or “RUCO” and additional alternative feedstocks including Tallow (animal fat) and Palm Fatty Acid Distillate (PFAD)”.

Eni declined to comment on the volumes of PFAD imported through its refineries in 2023, nor was it willing to share the percentage that PFAD represent amongst feedstocks which are being used to replace crude palm oil as such information is – allegedly – “market sensitive” and therefore “confidential”.

However, historical data retrieved from the company’s reports show that the large majority of feedstocks used at the Gela and Venice refineries were still coming from Indonesia and Malaysia in 2022, while there has been a clear switch from crude palm oil to ‘residues’ feedstocks coming from those same countries.

Indeed, in 2022, 86 % of the feedstocks used in Eni’s biorefining were still coming from Indonesia and Malaysia, from 95% one year before.

Whereas the use of crude palm oil has decreased , ‘residue’ feedstocks coming from those two countries have jumped from representing 55% to 69% of feedstocks processed at the refineries over the same period.

Oil World data also shows that volumes of PFAD imported into Italy have experienced a jump of 55% in the first half of 2023.

Following the boats

In July 2023 a chemical tanker named Lovestaken transported Palm Fatty Acid Distillate (PFAD), to be discharged at the Gela port for Eni’s refinery, according to data from Refinitiv and customs records analyzed by T&E.

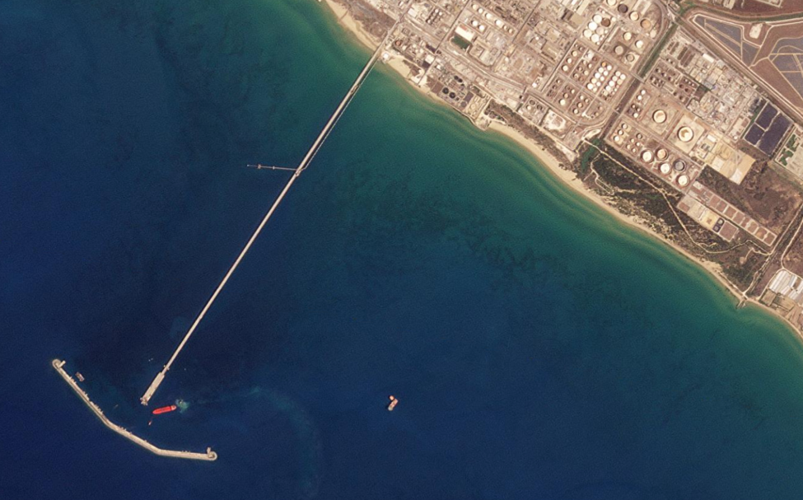

The Lovstakken tanker at the Gela refinery berth on 24-07-2024 (Planet Labs PBC)

The ship appears to have moored at the Gela refinery berth at the Gela harbor in Sicily, according to satellite imagery retrieved from Planetscope.

The month-and-a-half journey undertaken by the ship, from palm oil bulking terminals on the Indonesian islands of Kalimantan and Sumatra, through the Suez Canal, onto the docks of Italian refineries, exemplifies the pattern through which the Gela and Venice refineries have continued to be supplied with palm oil products throughout 2023.

The journey starts around June 13th 2023, where the tanker’s presence is captured by an Eni employee at the Bontang Lestari terminal, on the East side of Kalimantan Island.

The boat then heads to Balikpapan, according to data retrieved from the ship’s Automatic Identification System (AIS), confirmed by a picture taken by an Eni employee, where it appears to have stopped at the bulk terminal of LDC East Indonesia, a palm oil producing company subsidiary of the Louis Dreyfus conglomerate.

The Lovstakken tanker at the Bontang terminal on 13-06-2023 and at Balikpapan on 15-06-2024 (Tomasello Letterio on: shipspotting.com)

The boat then sails on to Sumatra, where it notably appears to have stopped at the jetty of a company belonging to another top international palm oil trading company, Wilmar, which owns a palm oil crushing and refining plant in Pelintung, close to Dumai. Analysis of AIS data shows the Loevstakken draught’s rose substantially at those locations, confirming loadings have been made onboard the ship.

Trade records accessed by T&E confirm LDC East Indonesia and Wilmar Nabati Indonesia have supplied the Lovstakken with PFAD, to be delivered at Eni’s Gela refinery.

On the 18th of July, the Loevstakken enters the Suez Canal, before getting to the Mediterranean, heading towards Sicily.

On July 22nd, the boat is joined by another tanker -the MRC Semiramis – off the coast of Sicily, where it performs a ship-to-ship transfer (STS), according to AIS data and images taken by an Eni employee. AIS data recorded changes in the Loevstakken draught confirm that some of the boat’s shipments got transferred to the MRC.

Ship to ship transfer between the Lovstakken tanker and the MRC Semiramis on 22-07-2023 (Tomasello Letterio on: shipspotting.com)

It is not possible to assess with certainty what products were exchanged by those ships as ships can perform STS for various reasons, notably logistical, but they can also be used to make traceability of products more difficult. It seems however that the STS was used in that case as part of the palm oil supply operations for the Gela and Venice’s refineries.

Indeed, after joining the MRC Semiramis, the Loevstakken then sailed to Gela where it seems to have moored at the Eni refinery berth around July 24th, according to satellite imagery. Its STS partner, the MRC, had headed towards the Venice refinery in Porto Maghera where it appears to have moored on July 30th. Analysis of AIS datashows both the Loevstakken and MRC’s draught decreased substantially at those locations, confirming unloading at the refineries’ berths.

More PFAD

A wider investigation into chemical tankers arriving at the Gela and Venice refineries’ berths suggests that Eni has continued to frequently import those products – PFAD – throughout 2023.

According to T&E’s investigation, at least four other tankers have transported palm oil based products from Indonesia to Eni’s refineries from January to July 2023 : the Blaamanen, the Falcon Sextant, the Eva Fuji, and the MTM North Sound.

Additional data retrieved by T&E from refinitiv and AIS show that 3 more ships carrying PFAD from Indonesia have arrived to Gela since July 2023, the latest in November 2023 : the Rundermanen, the Bochem Brussels, and the Rudolf Schulte.

All ships’ journeys followed a very similar pattern to that of the Loevstakken: starting with several stops at Indonesian ports before crossing the Suez canal towards Eni’s Gela refinery. Most ships performed ship-to-ship transfers with other ships that also headed to Gela or went to Venice, mooring at Eni’s refinery berths. Some ships also stopped in Malaysia, according to AIS data, where potential other loadings of palm oil products might have been made.

Eni declined to comment on the specific shipments identified as part of this investigation but confirmed that ‘PFAD is currently part of {their} feedstock mix”. The company also declined to comment on the date by which it will stop importing palm oil products, which remains unknown.

Tracking the fruit

As we have seen previously, crude palm-oil and its derivative increase risks of deforestation in producing countries through direct land conversion, but also indirect effects. However, both exporter and importer companies have heavily relied on international sustainability certification systems such as ISCC or RSPO, which do not eliminate deforestation risks in their supply chains, according to latest research.

European importers such as Eni, put a strong emphasis on the traceability of palm oil products along their supply chain, in an attempt to mitigate reputational risks.

In 2022, the company stated that (it) “traced 100% of the mills and plantations from which its palm oil was sourced for the Venice and Gela biorefineries”, and that “100% of the palm oil used is ISCC-certified”.

Analysis of Eni’s palm oil supplies in Indonesia shows that the traceability of their products do not comply with those statements. Specific grievances have also been filed against some of Eni’s suppliers, which further expose the company’s supply chain to deforestation risks.

Custom records seen by T&E indeed show subsidiaries of three main international commodity trading and Indonesian agribusiness companies have been supplying the Gela refineries with palm oil products in 2022 and 2023: Louis Dreyfus, Wilmar, and Golden Agri Resources. Those companies source from palm oil mills in areas on of Kalimantan and Sumatra which are within the top high deforested regions in Indonesia in recent years.

The suppliers’ own sustainability reporting shows that they haven’t attained a 100% traceability to specific plantations in 2022.

According to Louis Dreyfus palm traceability reports for 2022, a total of 26 mills supplied LDC East Indonesia’s refinery in Balikpapan.The company reported a 100% traceability to mill but only a 96.2% traceability to plantations for palm oil fresh fruit bunches processed at the refinery.

Beside LDC East, the Italian supermajor has also heavily relied on imports from another subsidiary of Louis Dreyfus: LDC Indonesia, which operates a palm oil refinery, biodiesel plant, bulking station and a port at Lampung, in South Sumatra. 32 mills supplied the Lampung refinery, according to the company’s latest sustainability report of which 100% are allegedly traceable to mills but only 85.4% are traceable to plantations.

The Wilmar subsidiary that operates in Dumai sourced palm from 109 mills, 20 of which were RSPO-certified, according to the company’s 2022 sustainability reporting. It also claims that 100% of the palm processed at the Dumai refinery is traceable to the mill, but only 85.6% at the plantation level.

Several deforestation grievance cases are also currently being investigated for a subsidiary of the Golden Agri Resources, Sinar Mas Agro Resources And Technology (SMART), which supplied Eni’s Gela refinery with palm oil products in 2022. Additionally, this company faced risks of expulsion from the RSPO due to breaches of the body’s sustainability criteria in 2010, when an investigation found evidence that the company cleared peatlands and rainforests in Central Kalimantan and Sumatra.

Golden Agri Resources and its subsidiaries have carried out massive wildfires and forest clearances to make room for palm oil plantations between 2015 and 2018, according to a report by Greenpeace, on top of land-grabbing for palm oil operations in Liberia.

Eni declined to comment on whether it has or continues to supply from palm oil producers identified as part of this research and did not confirm whether it can ensure a 100% traceability to mill and plantation for its ongoing PFAD imports.

Notes

For full methodology and sources, see the full PDF