The EU car CO₂ standards have driven the boom in electric car sales across Europe. In this report, Electric car boom at risk, T&E looks at the situation in 2021, analysing CO₂ emissions from new cars sold in the first half of the year and looking at the performance of individual carmakers. T&E has also published its position paper on the proposed new car CO2 standards.

CO2 emissions from new cars dropped by almost one fifth from 2019

The report shows that the sales of plug-ins have multiplied by four across Europe, and by five in the EU, with the entry into force of the 2020/21 CO₂ target: from 3% in the first half of 2019 to 16% in the first half of 2021 (7.5% BEV). This has led to a total reduction of CO2 emissions of 18% since the entry into force of the 2020/21 car CO2 regulation.

The majority of carmakers are already compliant, but 840,000 electric sales will be lost due to loopholes

Five groupings of carmakers (or “pools” as referred to in the law): Tesla-JLR-Honda, Volvo, BMW, Daimler and Stellantis are already compliant with the 2021 target as of July, six months before the deadline. Ford, Toyota-Mazda-Suzuki-Subaru and Kia are close with a gap of less than 2 g/km while Volkswagen, Hyundai and Renault-Nissan-Mitsubishi have gaps around 3 g/km. This shows carmakers are once again on track to meet their CO₂ targets and will all comply at the end of the year.

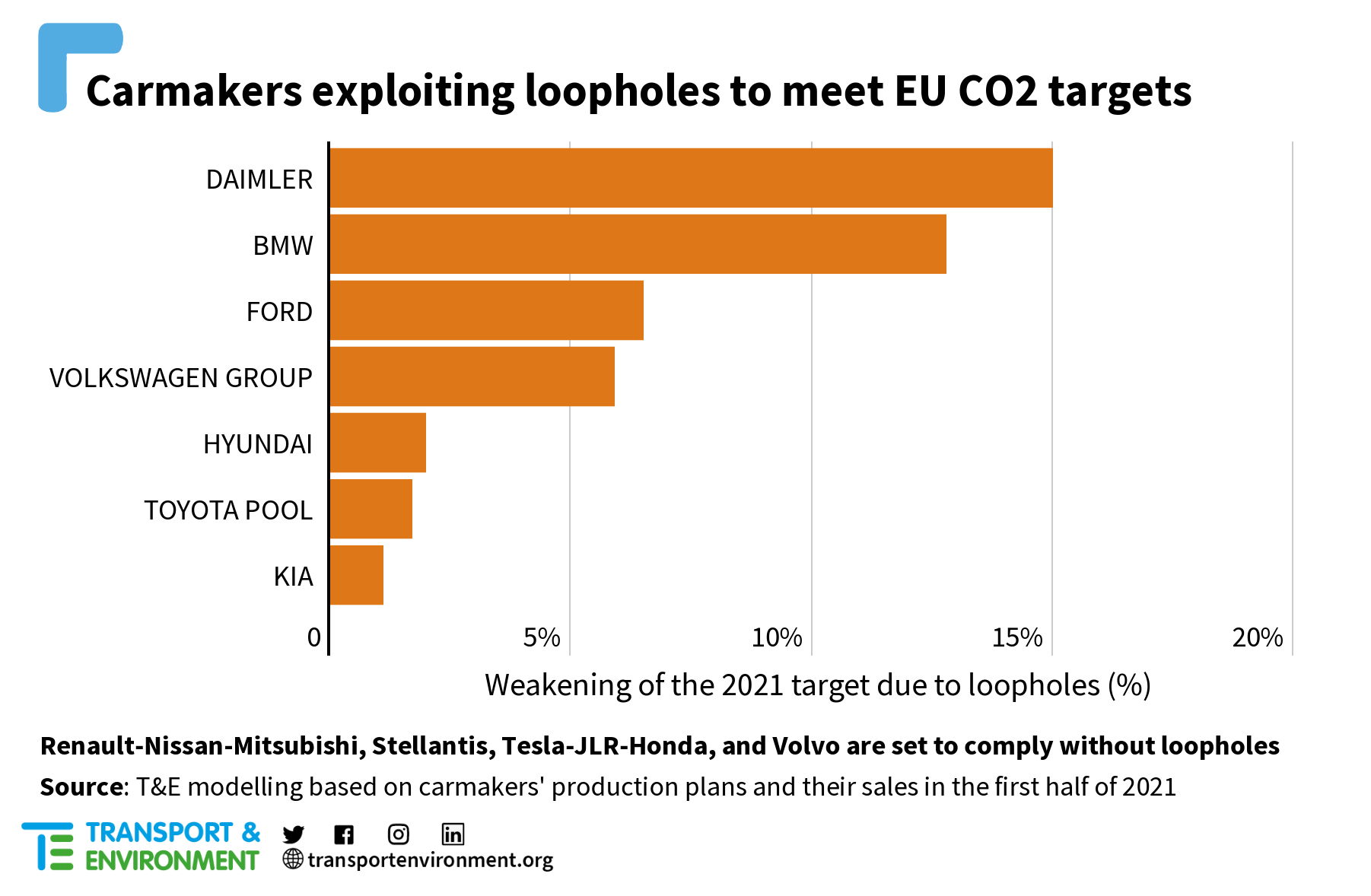

Carmakers’ CO₂ targets are weakened by regulatory loopholes

Four regulatory flexibilities – adjusting CO₂ targets for heavier cars, eco-innovation credits, super-credits multiplying sales of plug-ins, and pooling sales with other carmakers – allow carmakers to close 16% of the gap to the 2021 target. T&E calculates that these regulatory flexibilities, as well as the unrealistic CO₂ rating of PHEVs, will prevent the sale of 840,000 battery electric cars across Europe in 2021. This is the climate cost of the flawed design of the regulation.

Carmakers have different compliance strategies to reach CO₂ targets: Kia, Renault and Volkswagen rely on growing battery electric sales while Daimler, Volvo or BMW mainly focus on PHEVs. Others such as the Toyota OEM grouping, Ford and Stellantis have a stronger focus on engine efficiency and hybridisation. BMW and Daimler are among carmakers benefitting the most from flexibilities and would not comply without them.

For more information on carmakers performance, see the dashboard that follows.

Follow the race to electrify

T&E’s interactive dashboard shows key indicators for the CO2 emissions and electrification performance of carmakers in Europe.

Click below to navigate left and right.

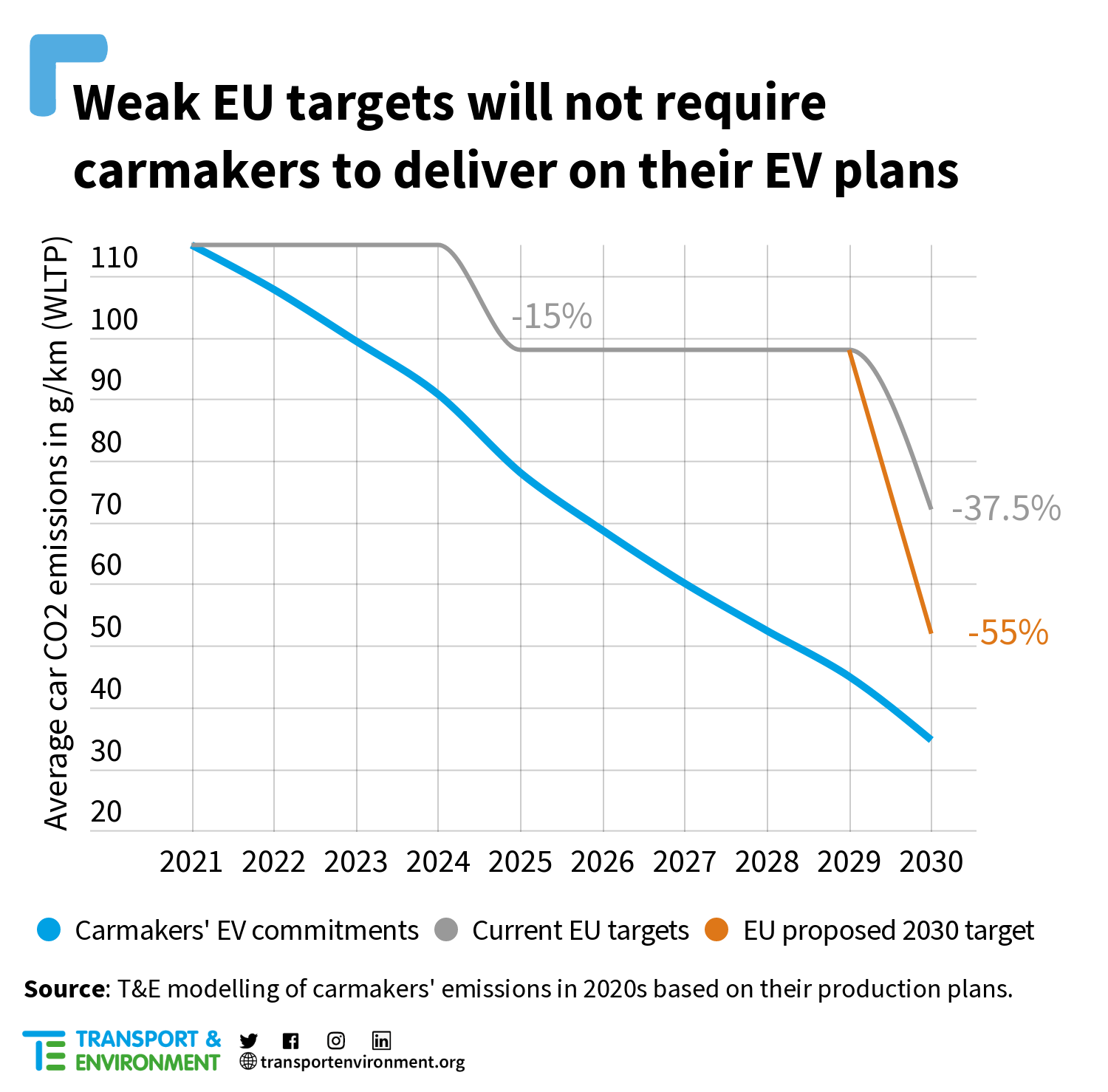

The regulation lags behind carmakers’ emobility potential

Looking beyond 2021, the analysis shows that because of the weak CO₂ standards for the period 2022-2029 the ongoing EV boom will taper off from 2022 onwards. The current CO₂ targets for 2025 and 2030 lag behind carmakers’ own plans for electrification.

T&E estimates that if carmakers deliver on their voluntary plans, the CO₂ from new cars would be reduced by as much as 30-35% by 2025. In comparison, the regulation asks for a mere 15% reduction that would be reached as soon as 2023. The CO₂ emissions would be further reduced by 45-50% in 2027, and 65-70% by 2030. This is double the 2030 target currently in force and is significantly above even the newly proposed 55% reduction.

Our policy recommendations

T&E recommends the regulation is amended by the European Parliament and the European governments to increase the current level of the targets:

- To ensure an effective CO₂ reduction and optimal supply of BEVs, Europe needs at least a 30% CO₂ reduction from new cars from 2025 and 45% from 2027.

- For the entire car fleet to be zero emission in 2050, the last new car with any CO₂ emitting engine must be sold no later than 2035. To be on the feasible path to 100% zero emission sales in 2035, sales of ZEVs will need to hit at least 67% in 2030, which corresponds to a CO₂ reduction target of -80%.

Flexibilities are weakening the CO₂ standards by allowing carmakers to cut planned BEV production and/or increase ICE vehicle emissions and remain compliant with the targets. T&E therefore recommends to improve the design of the regulation by:

- Removing the ZLEV benchmark and corresponding CO₂ bonus from 2025.

- Stopping the free CO₂ pass for heavier cars by removing the mass adjustment factor as well as limiting the CO₂ savings that can be claimed from eco innovations.

- Reforming the tests to provide realistic CO₂ rating of PHEVs, with the help of real-world data from fuel consumption meters.

For full details, download the full report. A more comprehensive Technical Annex focuses on trends in the past decades as well as carmakers’ compliance in 2020.