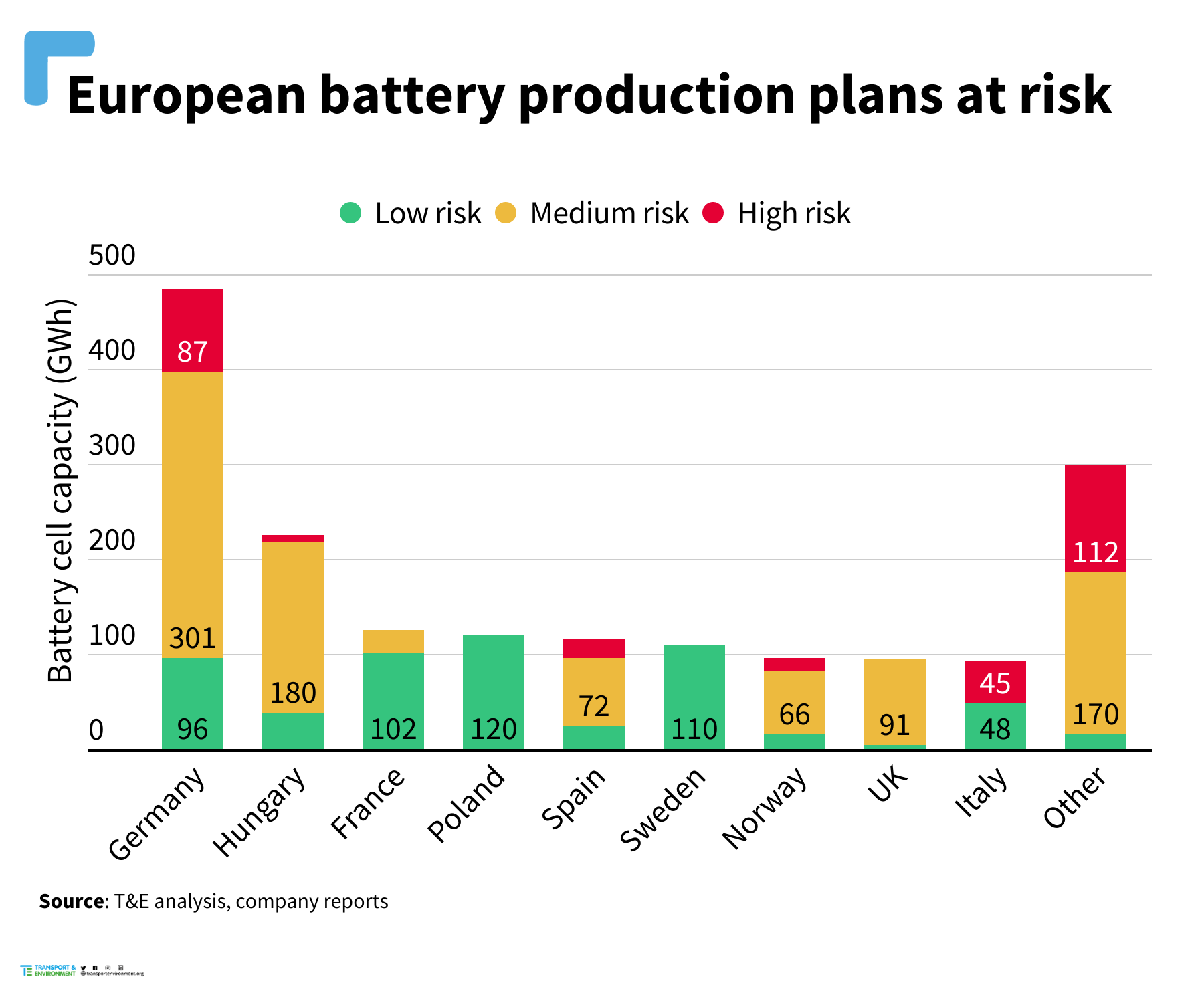

More than two-thirds (68%) of lithium-ion battery production planned for Europe is at risk of being delayed, scaled down or cancelled, new analysis shows. Tesla in Berlin, Northvolt in northern Germany and Italvolt near Turin are among the projects that stand to lose the greatest volumes of their slated capacity as the companies weigh up investing in the US instead. Transport & Environment (T&E), which conducted the research, called for both EU-wide financial support to scale up battery production and faster approvals processes to capture projects at risk from American subsidies.

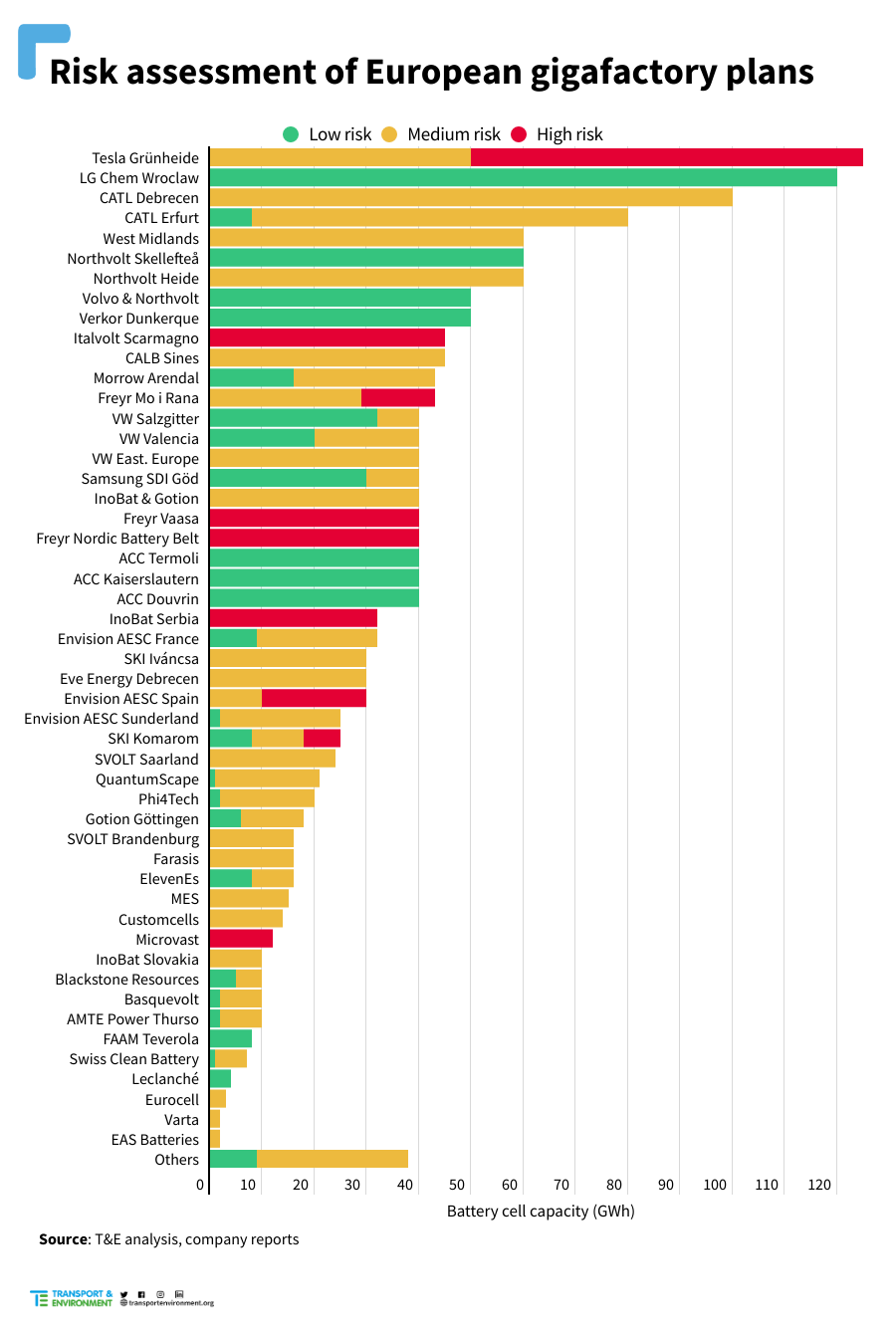

Battery production capacity equivalent to 18 million electric cars – 1.2 TWh – is at a high or medium risk of being disrupted or lost. Without this expansion, Europe will not be able to satisfy its battery demand in 2030 and will need to import from foreign rivals. T&E used publicly available information to assess the 50 gigafactories announced in Europe based on their finance and permits, whether they had secured a location, and the companies’ links to the US.

Julia Poliscanova, senior director for vehicles and emobility at T&E, said: “EU battery manufacturing is caught in the crossfire between America and China. Europe must act or risk losing it all. A green industrial policy focused on batteries with EU-wide support for scaling up production is urgently needed to react to US subsidies and China’s years of dominance.”

Germany, Hungary, Spain, Italy and the UK stand to lose the most if battery-makers change their plans. Tesla’s Giga Berlin plant has the largest volumes at risk of being delayed in Europe after the company said it will focus cell manufacturing in the US to take advantage of incentives under the Inflation Reduction Act. There is a medium risk to Northvolt’s planned gigafactory in Heide, Germany, as the company has only secured part of the funding and has not started construction. Also, Northvolt’s CEO said last October that it might delay the plant and prioritise expansion in the US.

Italvolt, whose CEO also founded Statevolt, in California, is at risk due to a lack of progress on the project since its launch in early 2021. To avoid the fate of Britishvolt, the planned West Midlands gigafactory in the UK still needs to find an investor. The report also places question marks over projects in Serbia and Spain by InoBat, which recently secured incentives for a joint venture with an American company in Indiana.

Europe’s global share of new investment in Li-ion battery production dropped from 41% in 2021 to a meagre 2% in 2022, according to BloombergNEF. Battery investment in the US and China continued to grow, and European companies have already signalled expansion in America. T&E said that companies’ limited resources to scale up production, as well as the tight supply of raw materials, are making the US-Europe battery race a zero-sum game.

Julia Poliscanova said: “Europe’s response should mirror the US Inflation Reduction Act in focus, simplicity and visibility. A central fund accessible to all member states should prioritise battery value chains, renewables and smart grids. The EU can’t compete unless it has a robust industrial policy which is focused on scaling up production and rewards environmentally sustainable projects.”

On 14 March, the EU Commission will publish a Net Zero Industrial Act, part of its response to the tax benefits and subsidies provided by the IRA for localising battery supply chains in America. T&E called for production targets, tax breaks and grants to scale up battery manufacturing while fully upholding Europe’s environmental standards. It also said a green simplification agenda was needed to streamline permitting and approval processes for projects.

Read more: Report – How not to lose it all