As Europe transitions to electric cars at scale and speed to match its climate ambitions, they need to become accessible to a wide pool of commercial and private drivers that need cars in their daily work and life. Many in the industry are talking about a €25k battery electric car (BEV), before subsidies, as the gold standard for mass affordability. But car prices are determined by many factors, including their size and market segment, the costs of components and materials, as well as the corporate mark-ups and profit margins. In this paper T&E looks at the EU car market in the last few years, car prices and automaker product strategies to answer the following question: is a €25k made-in-Europe BEV possible by 2025?

Higher profits per car despite the supply chain crunch

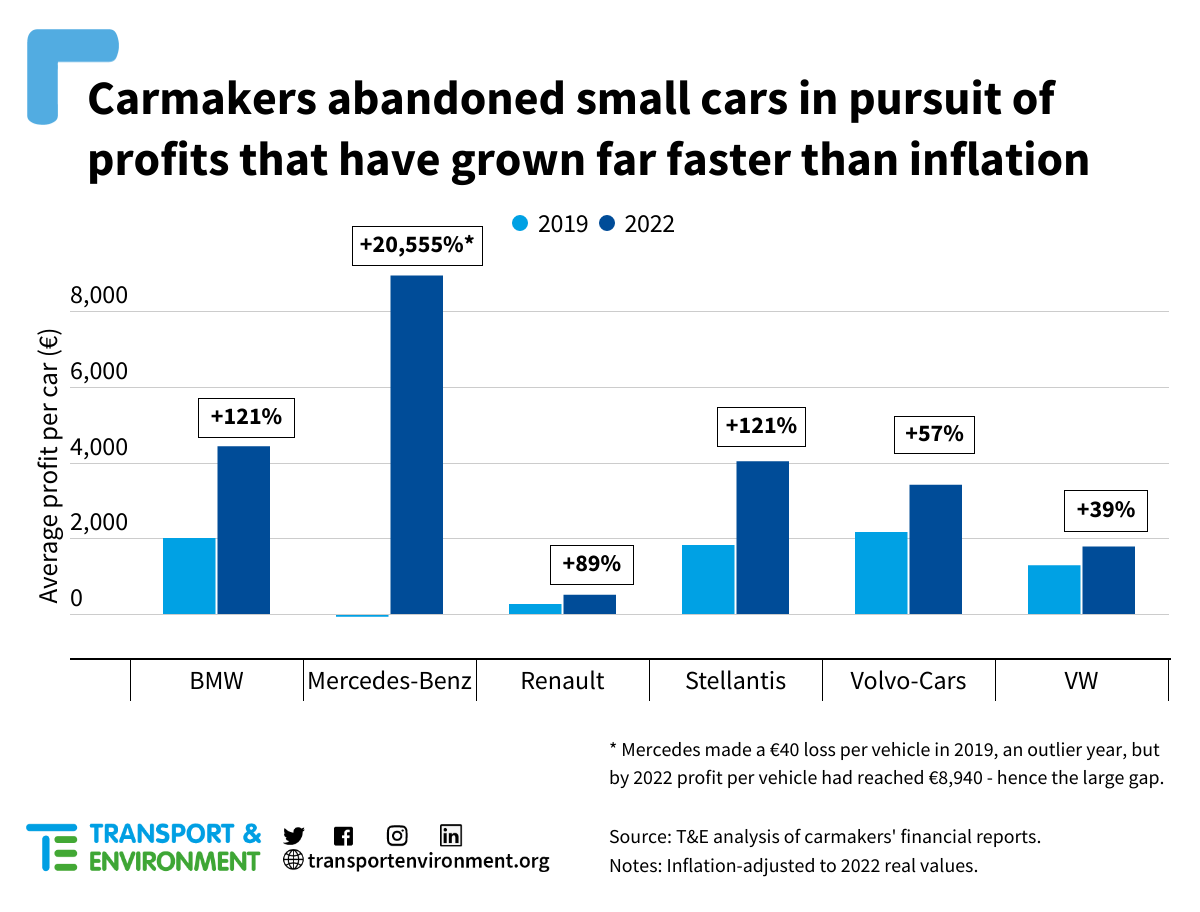

Anyone trying to purchase a car recently knows that car prices shot up following the Covid-19 pandemic. What is less known is that so have automakers’ profits. For the six carmakers analysed by T&E (BMW, Mercedes, Renault, Stellantis, Volvo Cars and Volkswagen) the revenue, or the gross income, per new car has increased significantly: between 33% and 52% between 2019-2022, or around 3-4 times more than inflation in the same period. This means car prices in Europe have grown 17%-34% on top of inflation.

More importantly, the amount of net profit per car – minus the higher costs of raw materials and labour – also increased from between -€40 to €1,920 in 2019, to €510 to €8,940 in 2022 in real, or inflation-adjusted values. This increase in profits accounts for up to 94% of all revenue generated over the same period. This means carmakers’ race for profits, rather than supply chain problems, are at the heart of making cars more expensive.

More SUVs, fewer small cars

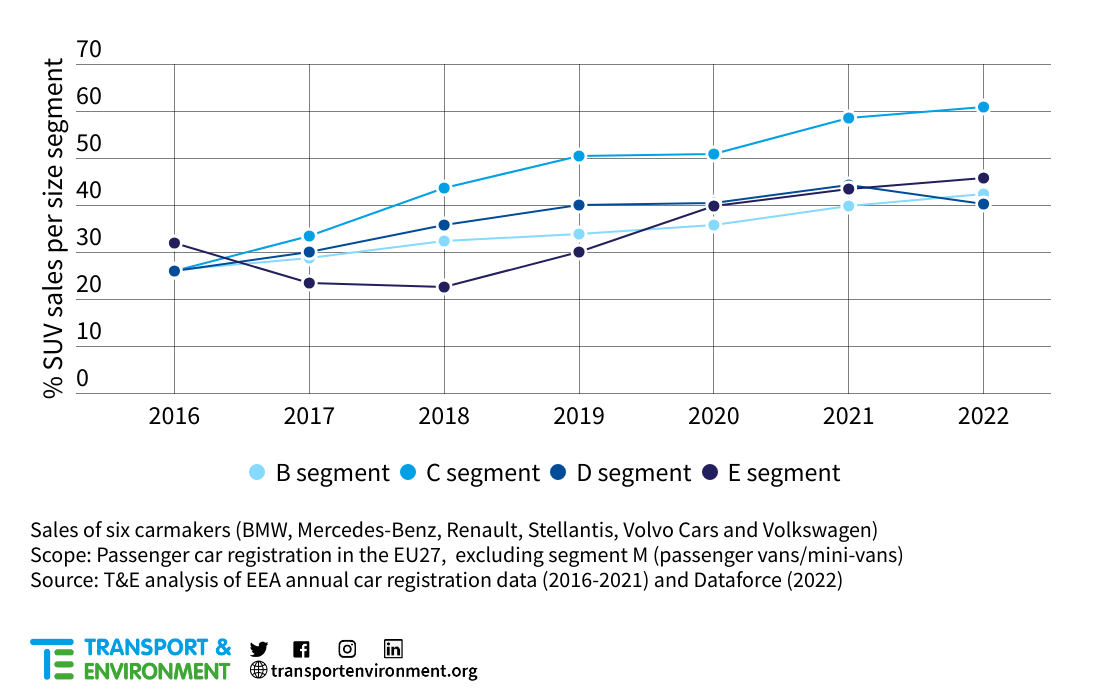

Another clearly visible change on Europe’s roads is that cars have become bigger. The evidence corroborates this: the sales of SUVs of the six carmakers made up just 9% of new cars in 2010. By 2022, this has ballooned to 47% (and 53% for all car sales) and continues to grow today. The sales are increasing across all brands and all powertrains, electric models included.

This is not a premium segment phenomenon. In fact, the SUV share has grown fastest in the middle (C) segment, which traditionally included medium-sized hatchbacks and sedans such as the VW Golf and Peugeot 308. This segment has the highest share of SUV sales (61%) today, representing over half of all SUV sales in the EU. The smaller (B) segment, which includes cars such as the Peugeot 208 and the Opel Corsa, accounts for the second largest share, at 30%.

Figure: Share of SUV sales per size segment between 2016 and 2022.

At the same time, small affordable car models that have defined Europe for decades are being discontinued. These include the Fiat Punto, Peugeot 108, Citroen C1 and, more recently, Ford Fiesta.

In public, automakers often blame the EU emission rules and changing consumer preferences. But on closer inspection it appears that their purposeful strategy to maximise profit per car is at play. While data on the exact profit margins of different car types is not available, carmakers have stated themselves at various investor days that SUVs are more profitable than non-SUVs (and so are mark-ups for dealers). T&E’s analysis of the equivalent SUV and non-SUV models for the six EU carmakers shows a price premium of 8-30%.

Economics of small BEV

Survey after survey shows cost to be a key barrier to a faster BEV adoption. T&E has commissioned YouGov in France, Germany, Italy, Spain, Poland and the UK to find out whether an offer of a €25k BEV would make a difference. If the survey results were replicated in the car market, the advent of affordable small BEVs would bring the sales share of fully electric cars to 35%. The increase due to the availability of small BEVs would result in an additional 1 million electric cars being sold annually, replacing combustion equivalents.

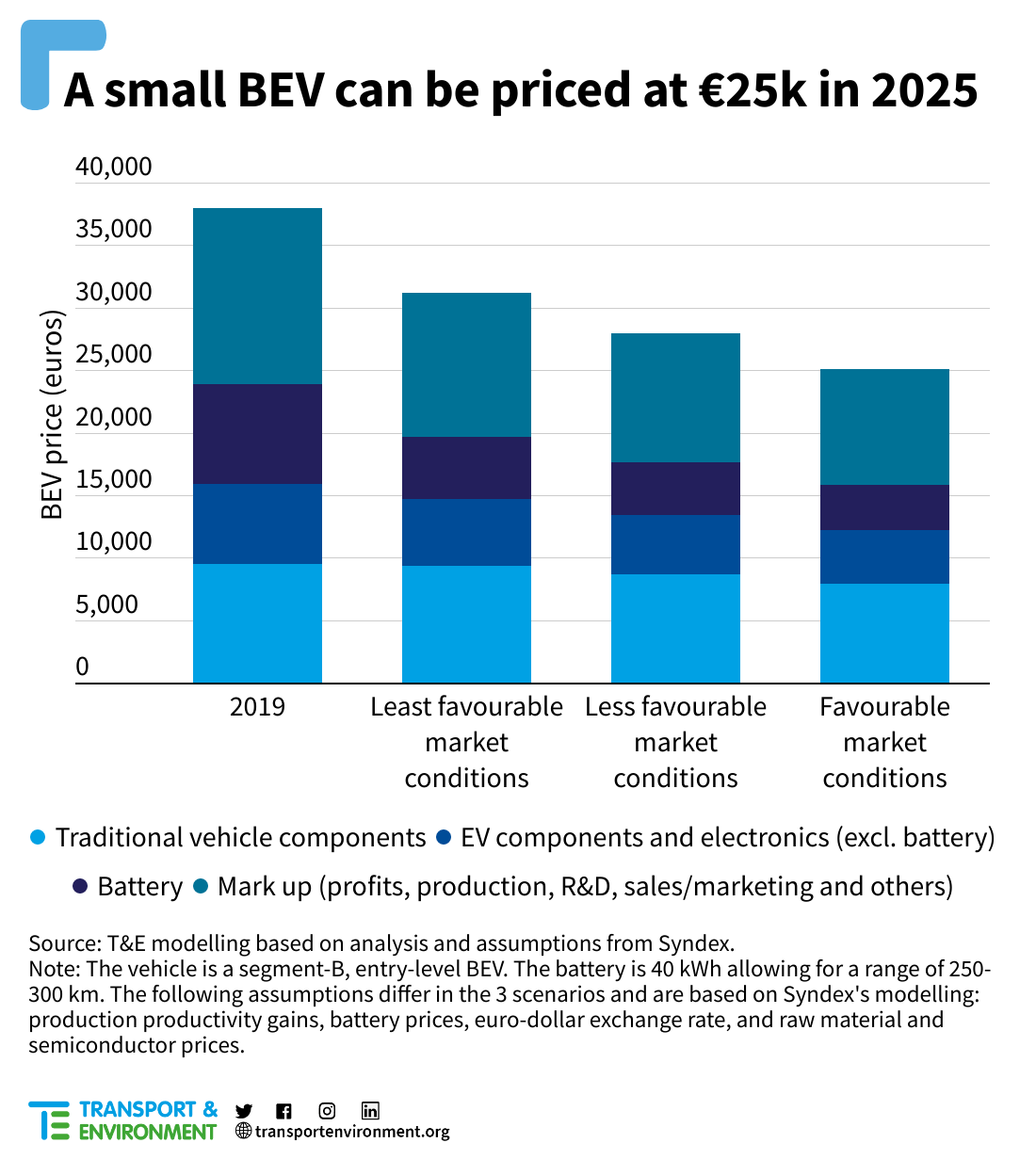

But as automakers’ drive for profits results in cars getting bigger and more expensive, the question is if an affordable entry-level battery electric model of around €25k is feasible by 2025. T&E has modelled three scenarios, building on the Syndex analysis commissioned for this purpose. The “favourable market conditions” scenario shows that a small segment (B) BEV produced in Europe in 2025 can be priced at €25k with a reasonable 4% profit margin. It would have a 40 kWh LFP battery and deliver a range of 250-300 km.

As electric vehicle manufacturing is picking up pace and a new supply of critical metals is coming online, such a scenario looks most likely. Just in the last few months Tesla, VW, Ford and others have either cut or hinted at cutting electric car prices. In addition, carmakers can reduce battery capacity (providing the charging network is ramping up), downsize vehicles themselves or revert to resource-light chemistries such as sodium-ion to leverage further reductions.

But while an affordable small BEV is feasible from the technology and market perspective, given the recent automotive dynamics it is not a guarantee that such models will be available on the European market at the speed and volume needed to accelerate access to electric mobility. And speed and volume are paramount to compete with Chinese rivals which are already offering cheap small electric cars in Europe. This means a joined-up strategy with measures at European (EV efficiency rules), national (vehicles taxes and subsidies that penalise weight) and local (weight-based parking charges) levels is needed to ensure European automakers prioritise the production of smaller cars away from resource heavy, expensive SUVs.