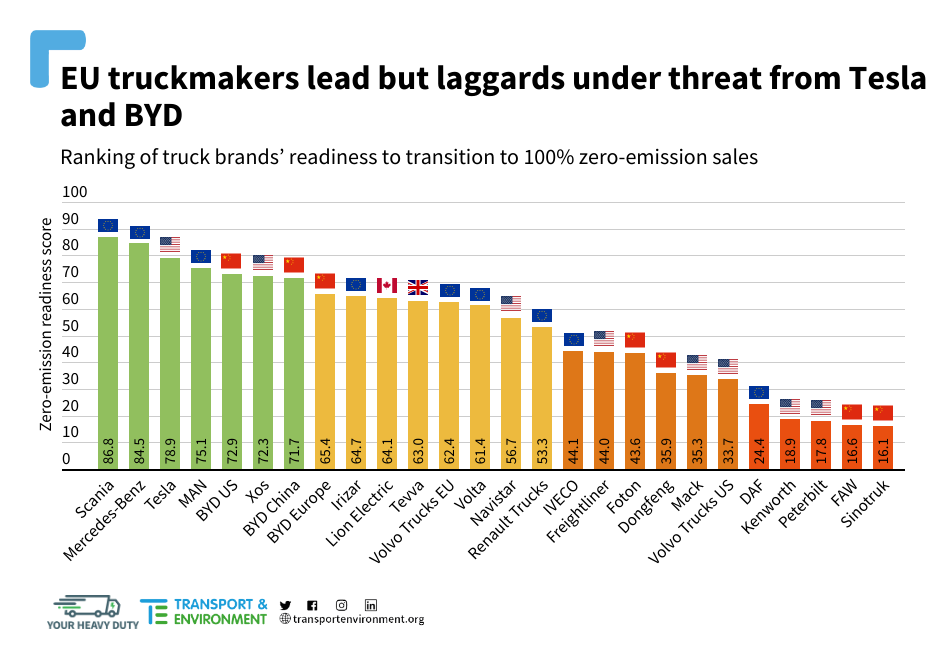

Three European truckmakers, along with Tesla and BYD, dominate a new global ranking of truck brands’ readiness to transition to 100% zero-emission sales [1]. Mercedes-Benz Trucks, Scania and MAN all aim to sell only electric or hydrogen trucks by 2040. But green group Transport & Environment (T&E), which compiled the ranking, warned that four major European truck manufacturers lag far behind and risk losing market share to the American and Chinese challengers unless EU truck CO2 standards are tightened.

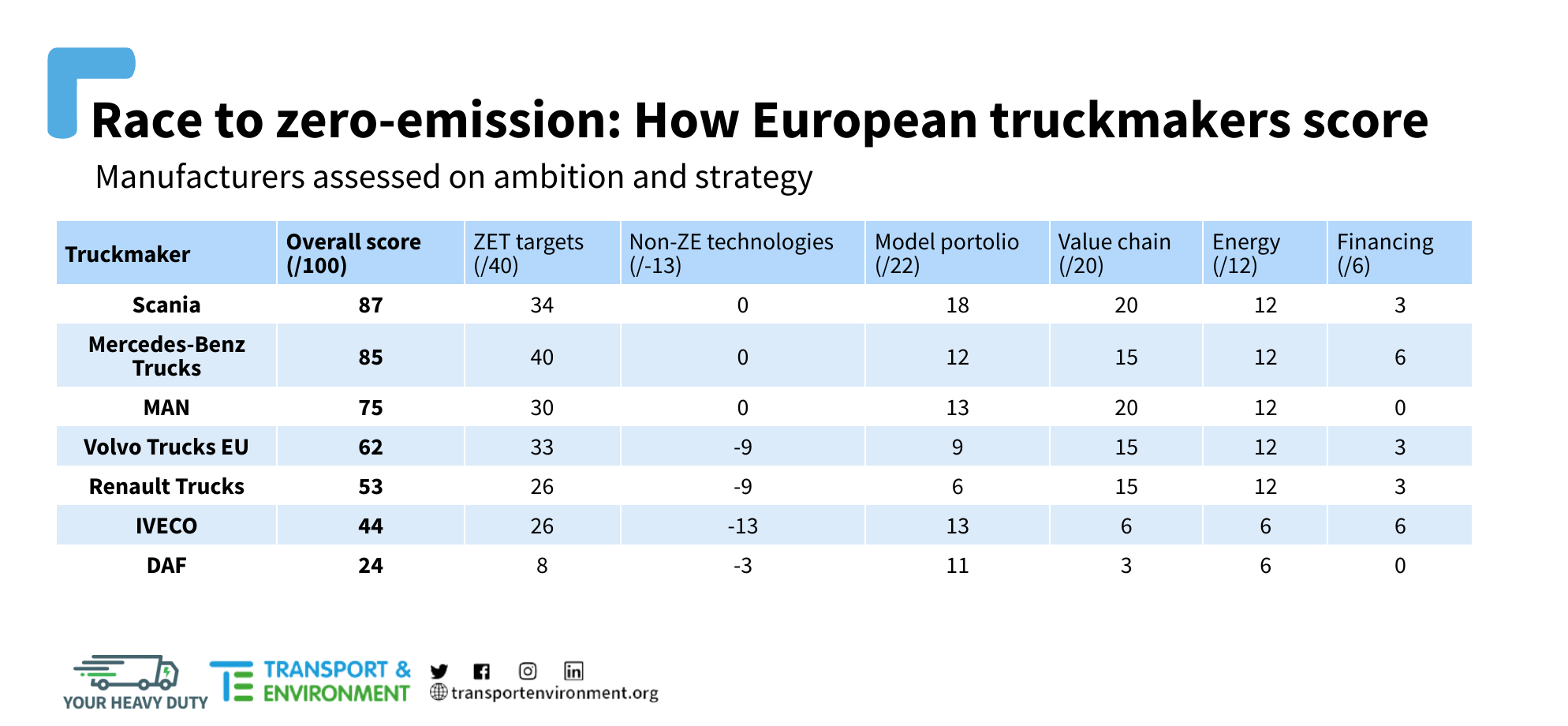

Scania leads the ranking of truckmakers’ climate ambition and strategies. While it only has a target of 50% of its sales to be electric or hydrogen in 2030, it has a very strong industrial strategy. Mercedes-Benz Trucks, in second place, aims for 60% of its sales to be zero-emission vehicles in 2030. However, there’s a gap between its announcements and its industrial plans. The company has a weaker battery strategy and has yet to secure a supply of battery raw materials. In fourth place, MAN plans a smaller line-up of electric models and has a weaker 2030 zero-emission goal.

Volvo Trucks, the current market leader in zero-emission truck sales in Europe and the US, finishes only mid-table. Despite its ambitious public commitment to reach 70% zero-emission sales by 2030, the company lacks a 100% zero-emission sales target and is investing in gas and biofuels – which still emit CO2. Trailing behind, Renault Trucks aims for half of its sales to be zero emissions by 2030 but it too is hedging on gas and biofuels. IVECO and DAF, which both lack long-term targets and have invested little in battery supply chains and charging networks, are ranked in the bottom half.

Sofie Defour, freight director at T&E, said: “European truckmakers all claim to be green, but the reality is less than half of them are on track to go to zero emissions and only via voluntary commitments. There’s a huge gap in the truck industry between manufacturers with a plan to fully decarbonise and those without. The EU needs strong truck CO2 standards to bring the whole European industry up to speed.”

European truck manufacturers face stiff competition from Tesla and BYD, which have already proven their ability to rapidly scale up zero-emission manufacturing in the cars market. They have also built strong battery supply chains including securing supplies of raw materials.

California’s 2036 diesel truck sales ban and the US Inflation Reduction Act could lead to truckmakers prioritising vehicle and battery production investments in America, the report also warns. This might result in truckmakers’ current voluntary commitments being changed or delayed. T&E said the EU needs to use the revision of its CO2 emission standards for heavy-duty vehicles to signal investment certainty in Europe and ensure truckmakers’ commitments are not abandoned. A higher 2030 target will be crucial to push manufacturers to rapidly improve their industrial strategies in the EU.

Sofie Defour said: “Tesla and BYD are poised to repeat their success in the truck market while Californa has sent a clear signal to truckmakers. That should set off alarm bells for European lawmakers who don’t want investments in manufacturing and batteries to go elsewhere. The EU must use its truck CO2 standards to give certainty to truckmakers to go zero emissions and invest in Europe.”

Earlier this month, T&E launched the Your Heavy Duty campaign, to advocate for higher CO2 reduction targets for European truckmakers to encourage investments, scale up supply and deliver on zero-emission trucks. The campaign is calling on EU lawmakers to:

- Set a CO2 reduction target of -65% in 2030, in line with what leading manufacturers have already announced.

- Set a CO2 reduction target of -100% in 2035 for freight trucks to ensure the last polluting vehicles will be off Europe’s roads in 2050. Without a similar target to California’s 100% mandate in 2036, the EU risks falling behind as major truckmakers could shift investments away from Europe.

- Keep fuels out of the CO2 standards: biofuels and e-fuels are expensive, false climate solutions to decarbonise new trucks. Truckmakers opposed to including fuels in the regulation make up over 90% of the market, with only laggards in favour of such a scheme.

- Extend the scope of the regulation to small trucks, vocational and non-certified vehicles, so that all new trucks are regulated.

Note to editors:

[1] T&E ranked European truckmakers’ readiness to transition fully to zero-emission truck sales. The ranking assesses the compatibility of their voluntary zero-emission sales announcements with climate needs, and the extent to which they are aligning their industrial plans and business activity with those targets. It also looks into how European manufacturers perform compared to their counterparts in the US and China, assessing who is best positioned to win the ongoing global race for leadership on commercial vehicle technology. The research ranks individual truck brands rather than OEM groups.

Read more:

Report: Ready or not – Who are the frontrunners in the global race to clean up trucks?