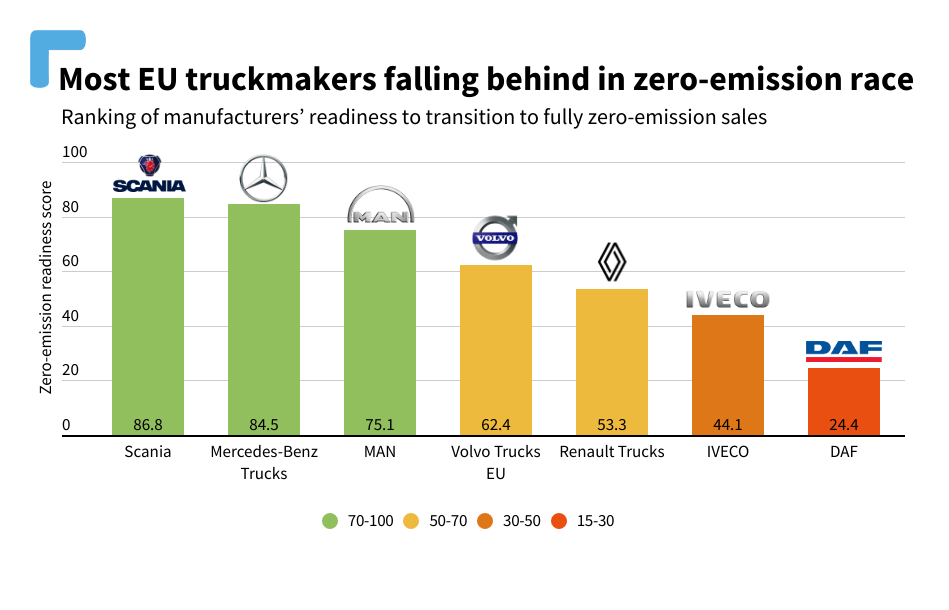

T&E ranked European truck brands’ readiness to transition fully to zero-emission truck sales. This report assesses the compatibility of their voluntary zero-emission sales announcements with climate needs, and the extent to which they are aligning their industrial plans and business activity with those targets. This helps identify the gap between announcement and plans, and the role for regulation to ensure a speedy transition.

- Scania, Mercedes-Benz Trucks,and MAN lead in Europe

- Volvo Trucks, current leader in battery-electric truck sales in Europe, finishes mid-table

- Renault Trucks and IVECO lag behind, and DAF comes last

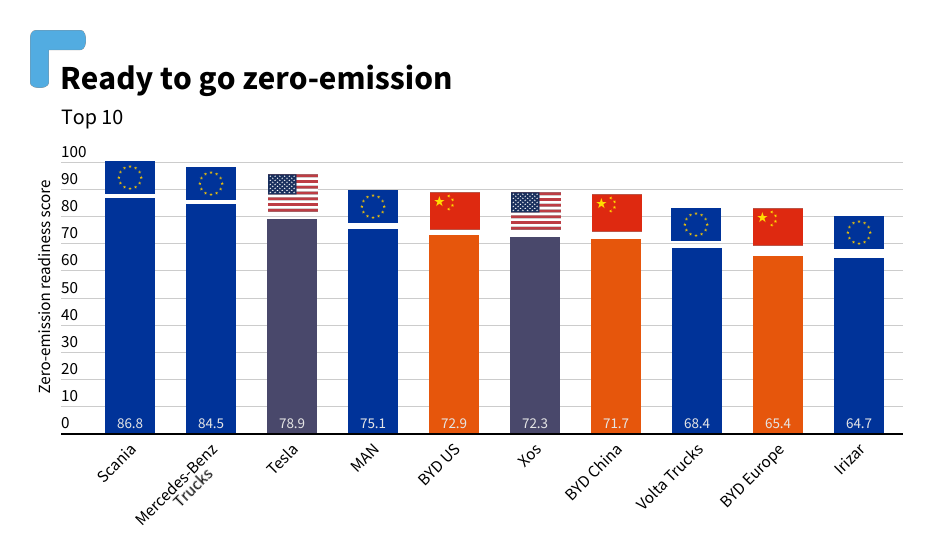

The report also looks into how European manufacturers perform compared to their counterparts in the US and China, assessing who is best positioned to win the ongoing global race for leadership on commercial vehicle technology.

- Tesla and BYD outcompete most European truckmakers

- Both have experience in rapidly scaling up zero-emission cars, and have built strong battery supply chains, including securing raw materials.

- Ambitious HDV CO2 standards are needed for laggards to keep up with international competition.

Scania, Mercedes-Benz Trucks, and MAN in the lead

Scania, Mercedes-Benz Trucks, and MAN are the three European frontrunners based on their announced ambition and strategy. All three aim for 100% new zero-emission truck (ZET) sales by 2040 or earlier. Volvo Trucks is the current market leader in battery-electric truck sales in Europe and the manufacturer with the most ambitious 2030 target (70% ZET sales share). But the company is not committed to only truly zero-emission technologies in the long term. Renault Trucks and IVECO Group are lagging behind in the transition. DAF closes the ranks with a very weak score, having no public ZET target for 2030, and scoring the lowest of all legacy manufacturers on battery value chain. Strong CO2 standards for trucks are needed to ensure frontrunners keep their promises and laggards catch up.

Tesla and BYD outcompete most European truckmakers

When comparing readiness on a global scale, European manufacturers only have four representatives in the top ten. Both the US and China have champions in Tesla and BYD, the latter already selling trucks in all three regions. These new entrants on the truck market could pose a threat to established truckmakers in coming years. Both Tesla and BYD have experience in rapidly scaling up zero-emission manufacturing in the cars segment. They have built strong battery supply chains, including securing raw materials.

Compared to legacy US and Chinese truckmakers, European manufacturers appear to be better prepared to go to zero-emission. This is partly because forthcoming stronger CO2 standards have incentivised EU manufacturers to announce voluntary zero-emission sales targets for 2030 and 2040. However, voluntary commitments can be missed or changed, and we identified a gap with some of these manufacturers’ industrial strategy. What matters is how fast the EU market will have to decarbonise compared to others, as regulations drive truckmakers to develop robust investment plans.

Looking ahead, the recently adopted Californian regulation to sell only zero-emission vehicles from 2036 is expected to spur major US truckmakers to decarbonise faster. With most EU OEM groups also active in other markets, this could potentially refocus group level investments from the EU to the US. Combined with the support for battery supply chains from the Inflation Reduction Act (IRA), the legacy US truck brands could quickly catch up and outpace European brands.

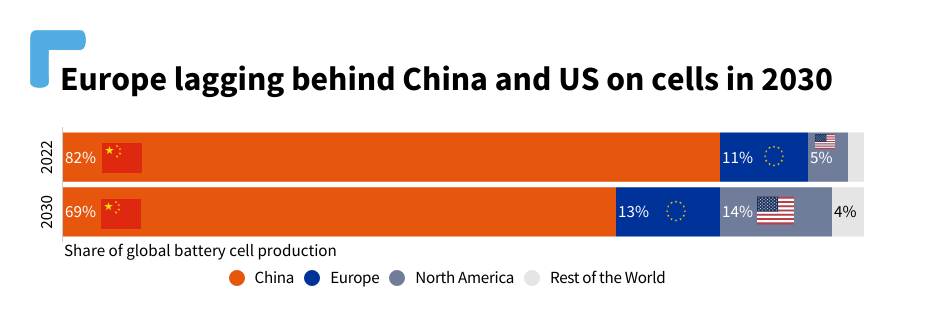

Stronger action needed to secure battery supply

Tesla, BYD, and TRATON’s Scania and MAN are the only truckmakers to have secured long-term supplies of battery raw materials, which they did primarily to secure their car market segment. Truckmakers who are less connected to carmakers have to build their own battery value chains (either in-sourcing or through partnerships), and risk being too late to secure raw materials. Unless European truckmakers become part of comprehensive battery ecosystems, their leadership risks being challenged in the coming years. Ambitious HDV CO2 standards are needed to create a signal for the battery industry to invest in Europe.

As China currently leads the battery market, it is unlikely that Chinese manufacturers will have trouble sourcing batteries. Meanwhile, the IRA will boost investments in battery manufacturing in the US. Already, two-thirds of battery capacity planned in Europe is potentially at risk if strong industrial policy and funding is not put in place to secure the plans. Without strong signal and offtake from European truckmakers, parent companies with both European and US subsidiaries could prioritise developing battery supply chains in the US, where e-truck regulations are currently stronger.

How Europe can win the race

Europe can use the HDV CO2 emission standards to ensure European truckmakers remain in the lead. This legislation is currently under review. But the new targets proposed by the European Commission are unlikely to deliver the needed push for frontrunners Scania, Mercedes-Benz Trucks, and MAN to remain ahead of the pack; for laggards IVECO and DAF to catch-up; and for newcomers Tesla and BYD not to outcompete those laggards. Instead lawmakers should:

- Set a CO2 reduction target of -65% in 2030, in line with what leading manufacturers have already announced.

- Set a CO2 reduction target of -100% in 2035. California has already adopted a 100% sales target for HDVs from 2036. The US as a whole has signed the Global Memorandum of Understanding, committing to 100% ZET sales by 2040. Without a similar 100% target, the EU risks falling behind as major truckmakers could shift investments away from Europe.

- Extend the scope of the regulation to small trucks and vocational and non-certified vehicles, so that all new trucks are regulated. California’s zero-emission mandate covers all trucks without exemption, proving all truck categories can decarbonise.

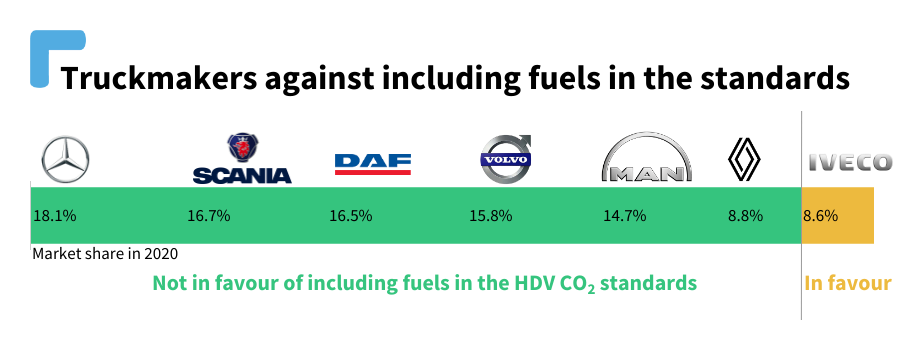

- Keep fuels out of the CO2 standards: biofuels and e-fuels are expensive and false climate solutions to decarbonise new trucks. Truckmakers opposed to including fuels in the regulation make up over 90% of the market, with only laggards in favour of such a scheme.