Leasing deals for battery electric vehicles (BEVs) are being overpriced, new analysis by T&E of the used car market finds. In Europe, leasing offers for BEVs are on average 57% more expensive than their equivalent petrol models. For example, leasing an electric Peugeot 208 costs approximately €574 a month, whilst the petrol Peugeot 208 is offered at €371.

Battery electric cars have similar resale value to diesel and petrol vehicles, the analysis finds. Leasing companies typically charge customers for the expected loss in value of a vehicle over the three to four year lease, so higher lease prices mean they expect BEVs to lose more of their value. But this is no longer the case.

The higher leasing prices for battery electric cars are unjustified. T&E analysis of 2.7 million used car prices reveals that BEVs do not depreciate more than other types of cars. Depreciation for BEVs in Europe’s biggest markets (Germany, France and the UK) is on par with diesel and petrol. In Spain there is still a difference but the gap is closing.

The study confirms that BEVs keep more of their value over time, reflecting consumer confidence in newer models with improved technology. Consumer demand for battery electric cars, new and used, is at an all time high.

Stef Cornelis, director of electric fleets at T&E said: “Today customers are being overcharged by leasing companies if they want to switch to a battery electric car. Leasing firms are too conservative when setting their monthly prices. Their rates reflect the state of play from 5 years ago. With this pricing strategy, their profits are obviously high and consumers are overpaying to go electric. At the same time, they are harming the BEV transition.”

Leasing companies – with a fleet of 12 million vehicles in Europe – have an outsized role to play in the transition to battery electric cars. In 2022, they accounted for 22% of new car registrations in Europe, the study finds. Leasing companies are often owned by banks and car manufacturers, the likes of Lloyds Bank (Lex Autolease), Société Générale (ALD), BNP Paribas (Arval), Volkswagen (VW Financial Services), and Mercedes-Benz (Athlon).

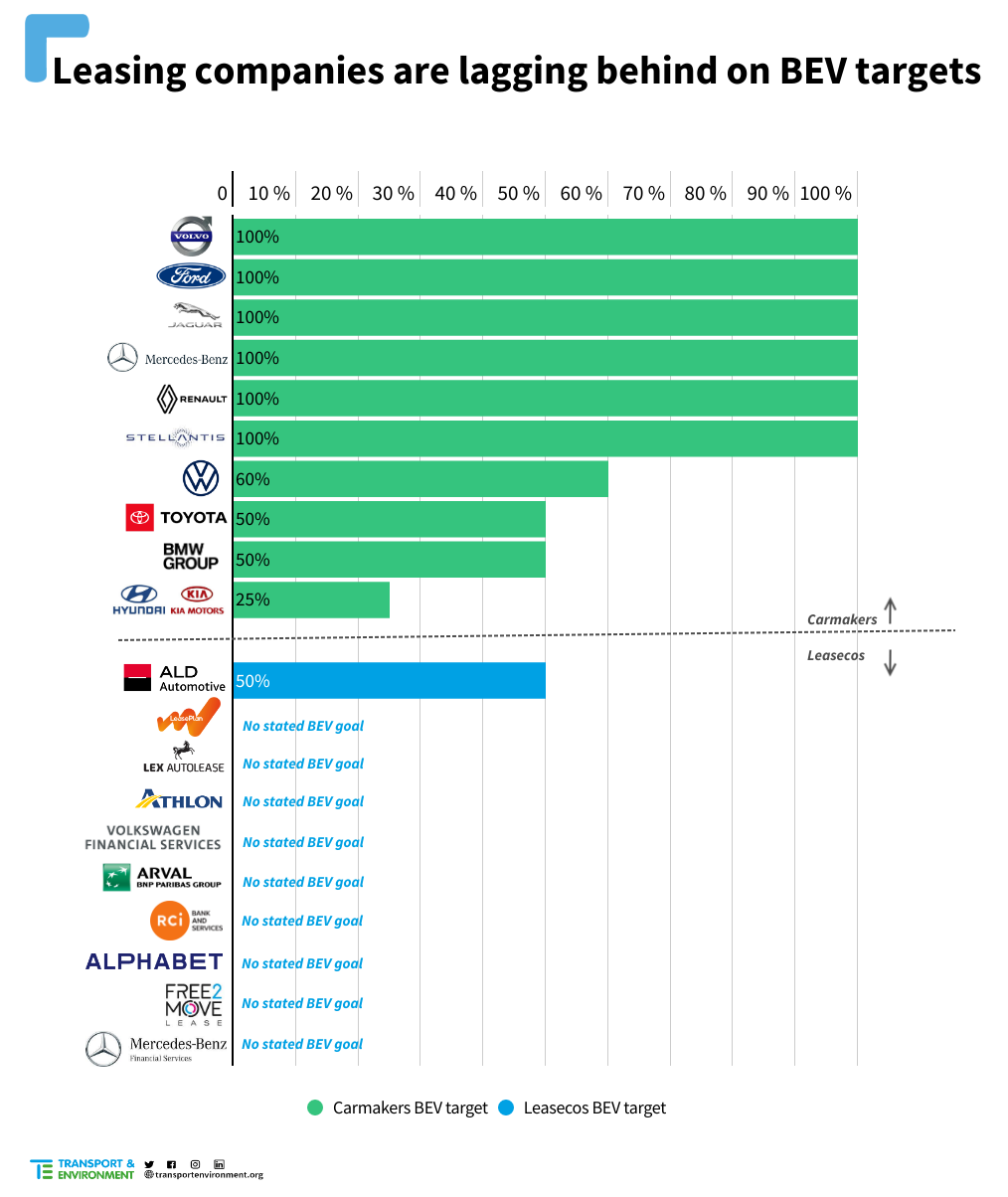

None of the leasing companies have targets to become fully battery electric by 2030. The ‘EV’ targets that they have set are weak and include plug-in hybrids (PHEVs) – which emit just as much as petrol and diesel cars. Their commitments are far behind market dynamics as large carmakers have already committed to 100% battery electric by 2030.

As a result, the leasing sector is not leading on the BEV transition. The study finds that in France and Spain, BEV uptake in the leasing sector is lower than other corporate fleets and even private households. The UK stands out as an exception where the leasing sector is leading the BEV transition with a BEV uptake of 34%.

Cornelis concludes: “These giants of the auto world have gone unnoticed and are slipping through the cracks. Looking at their weak targets for battery electric vehicles, leasing companies are climate laggards and not green leaders. Unless they rapidly accelerate their electrification plans, we will struggle to supply a second-hand market that will make BEVs affordable to far more people and we further delay the decarbonisation of the transport sector.”

Read the study here.