Charging and refuelling infrastructure is often cited as the main obstacle for an obligation on truck manufacturers to ramp-up zero-emissions truck and bus sales more quickly. T&E has analysed the public charging infrastructure targets recently agreed under the new EU Alternative Fuel Infrastructure Regulation (AFIR), as well as the additional deployment plans in Germany, and compared public charging availability with the projected energy demand of the zero-emission heavy-duty vehicle (HDV) fleet in 2030. We found that AFIR will provide sufficient public charging infrastructure EU-wide to reduce the CO2 emissions from new HDVs by -65%, and will be more than enough for the -45% target proposed under the HDV CO2 standards by the European Commission.

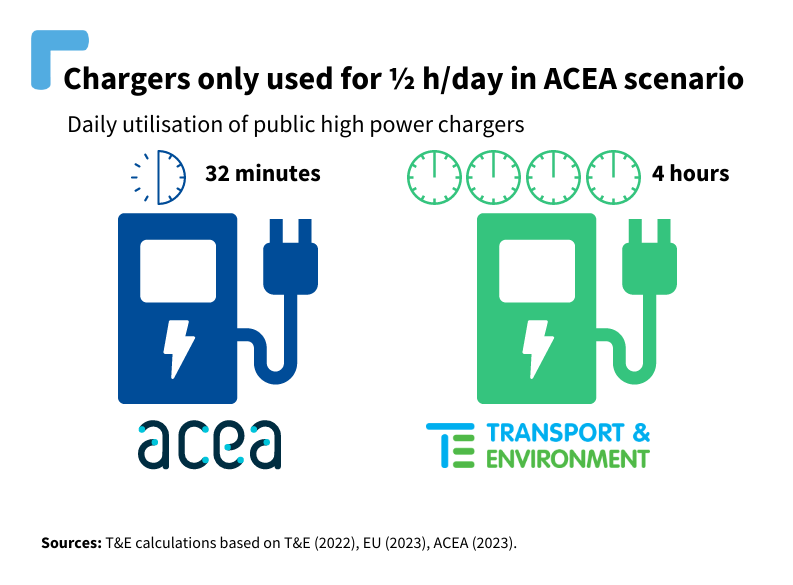

AFIR obliges each EU member state to install a minimum of one charging hub exclusively for HDVs every 60 km (TEN-T core) to 100 km (TEN-T network) in each direction of travel by 2030. It represents the world’s first of its kind. Some member states have already announced they will go beyond AFIR. Based on AFIR and the infrastructure plans in the central truck transit country Germany, we project that an annual charging energy of 13.79 TWh will be available in 2030. This is under conservative assumptions such as a utilisation of high power chargers of only 4 hours per day.

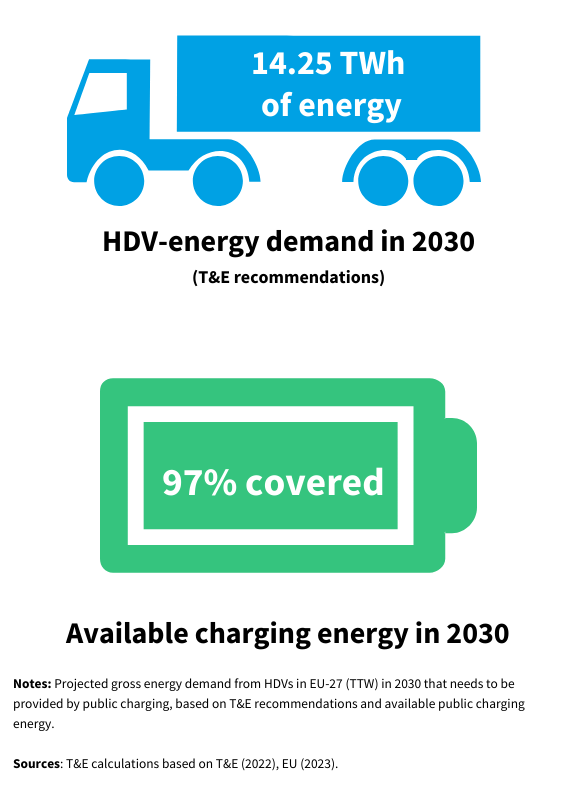

To estimate the demand, we looked at the zero-emission sales targets of the HDV CO2 standards. The Commission has recently proposed a new 2030 target of -45% in 2030. This would lead to a public energy demand from the battery electric truck and coach fleet of 8.13 TWh, or 41% below the charging available under the new AFIR. This risks leaving a large proportion of the planned infrastructure unused, potentially undermining the business case of companies such as Milence. On the other hand, if EU lawmakers were to increase the CO2 target for 2030 to -65%, the HDV fleet would have a charging energy need of 14.25 TWh, much closer to what the AFIR will provide. The projected infrastructure would then be capable of supplying 97% of the required public charging demand.

AFIR will also lead to the deployment of sufficient hydrogen refuelling infrastructure. Under the assumption of a -65% target in 2030, the hydrogen powered HDV-fleet is expected to require 344,000 tonnes of hydrogen annually by 2030. The mandated targets in AFIR alone will provide 337,000 tonnes per year, covering 98% of the needs.

Beyond Germany, this analysis does not take into account the plans of other member states – such as the Netherlands and Austria – whose charging plans also go beyond their respective obligations under the AFIR. In addition, a number of private Charging Point Operators (CPOs) are ready to deploy truck charging infrastructure on a large scale in the next couple of years. It is therefore very likely that this analysis is on the conservative side of what charging infrastructure will be available in 2030.

Finally, we looked into recommendations made by truck makers for the deployment of public charging infrastructure. Their demands would lead to a total installed charging power of 30.25 GW in 2030, meaning the infrastructure would be able to power a fleet of electric trucks almost 4.2 times the projected size in 2030. This recommendation entirely disregards the fact that many electric trucks will charge at private locations. If the ACEA recommendation were to materialise, it could potentially have adverse effects on charging businesses who invest in heavy-duty vehicle charging infrastructure. This is mainly due to the expected low utilisation of the charging equipment (just 32 minutes each day). As a result, there may be a considerable risk of financial loss, which may prompt the need for costly public subsidies funded by taxpayers.

MEPs and EU-governments can ramp up CO2 reduction targets for trucks in 2030 as high as -65% with confidence that there will be enough charging available. In fact, clean truck targets adequate to the expected availability of charging infrastructure are key for efficient utilisation and subsequently the business case for CPOs.

To find out more, download the analysis.