In September, France announced new green eligibility rules for awarding electric vehicle subsidies – a first in environmental policymaking. Starting in 2024, the government incentive of €5,000-€7,000 will only be awarded to electric cars with a production carbon footprint below 14.75 tonnes of CO2. [1]

This initiative has many advantages and could be replicated by other European countries. Italy, in fact, has already expressed interest in the approach. But for this incentive scheme to be replicated in an effective and robust way across Europe, the methodology will need some fine-tuning.

Supporting European industry with targeted subsidies

Although the French green bonus aims to reduce the environmental impact of cars and would incentivise clean materials and energy for car production, its goal extends beyond the environmental stakes. It’s a backdoor to promote cars that are made in France and Europe, earmarking subsidies specifically for these models. Indeed, electric vehicles imported from countries with highly carbon-intensive energy mixes, like China, will not qualify for the financial incentive and will lose some of their competitive edge.

As a response to American and Chinese electric car subsidy policies, Europe expanded its state aid mechanisms and has announced a probe into Chinese subsidies for imported models. But France was hoping for more. It has now decided to take it one step further with this new green bonus. By introducing this environmental prerequisite, France is effectively adopting a new industrial policy tool to protect the competitiveness of the European car industry, which has been threatened by the influx of cheaper Chinese electric models.

But does the shortsighted European car industry – which delayed electrification to profit from polluting vehicles for far too long – deserve our subsidies? It’s a fair question, but this is also about ensuring that Europe retains its industrial base. We need to avoid a future where all our electric cars are produced in China, and where hundreds of thousands of jobs are lost in Europe. Local content rules that favour less carbon-intensive production must have a role to play if we really want a flourishing EV industry in Europe.

French rules will exclude a quarter of EV sales from subsidies

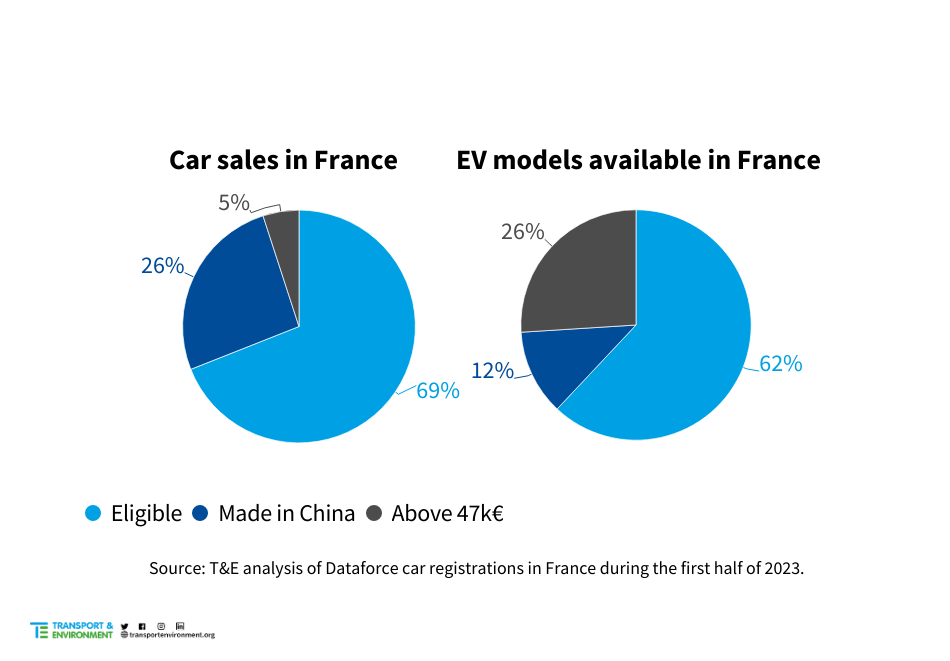

The list of eligible vehicles has been published today by the French government. It shows that 6 Chinese-produced EV models would lose their EV subsidies: the Dacia Spring, Tesla Model 3, and four SAIC MG models [2]. Together these vehicles account for 26% of EV sales but 12% of the EV models. As a result, more than two-thirds of EV sales in France (69%) would still be eligible for the bonus.

Figure: Share of car sales and car models eligible for the new French eco-bonus [3]

Most premium EV models would not be eligible because they exceed the price threshold of €47,000 (e.g. Audi Q8 e-tron, BMW iX3, Mercedes EQE). Together we estimate these models account for around 26% of models or 5% of sales.

A European guideline to improve and rollout

While it is an ambitious law, the current methodology fails to address several critical shortcomings in the French and European automotive sector, including the insufficient supply of compact electric vehicles, and a heavy reliance on Chinese batteries. As a result, under current rules, all models whose carbon footprint is below 14.75 tCO2eq will be eligible, and no distinction is made between models like the small Renault Twingo and the Peugeot e-3008 SUV. In addition, the French methodology fails to provide sources for the assumptions and emission factors used.

There is a risk that the adoption of new criterias on the carbon footprint of car production by European countries would create a more fragmented and complex fiscal landscape. Each country would choose the assumptions and parameters that best fit their interests, thus sending very mixed signals to the industry and consumers. In fact, for the initiative to be truly effective, broader adoption and alignment across Europe is essential.

The European Commission must deploy a clear vision and develop guidelines for how EU countries can implement such green subsidy rules to ensure both harmonisation and effectiveness.

Firstly, it must be backed by a more robust and transparent methodology. T&E recommends aligning the methodology with existing and forthcoming European regulations (particularly the Batteries Regulation and the Carbon Border Adjustment Mechanism, or CBAM, for steel and aluminium), which have standardised approaches to calculating carbon emissions.

Secondly, T&E also recommends a tiered approach where vehicles with lower CO2 footprints would reap a larger financial incentive in order to better reward the best in class models.

Third, to maintain consistency across the sector, this scale could subsequently be applied to other areas of car taxation, particularly for corporate car taxes.[4]

Finally, public money allocated for EV subsidies must come with clear and strong conditions: carmakers must unequivocally support the 2035 phase-out of combustion engines.

Recently, the European carmakers association, ACEA, called policymakers to create favourable conditions for small electric vehicles produced in Europe. Prioritising public subsidies to small EVs made in Europe is a good starting point.

In short, European countries should be in favour of such eco-bonus as it rightly supports the EU industrial base by rewarding cars produced with a lower carbon footprint It also ensures that taxpayer-funded subsidies are not spent on vehicles already receiving foreign state aid. EU guidelines would serve as a stepping stone for countries to adopt this.

Such a policy has the potential to chart a new course for national and European vehicle policy. A small, but encouraging, step towards the deeper clean up of the high carbon footprint of the automotive industry.

Notes:

[1] The current EV bonus provides private and corporate buyers with a subsidy of between €5,000 and €7,000 (depending on the income of the household) for an electric vehicle weighing less than 2.4 tonnes and costing a maximum of €47,000. The extent to which the vehicle is produced with recycled or bio-based materials will also be gradually factored into the new bonus criteria.

[2] The four MG models: MG 4, MG ZS, MG Marvel R, MG 5. This also excludes other small scale EV models (less than 100 sales in the first half of 2023) from BYD (Atto, Han and Tang) and Airways U5. The BMW iX3, also produced in China, is above the 14.75tCO2 threshold but is already excluded from the subsidy because it is above the maximum price threshold.

[3] T&E estimates are based on the initial list of models published by the French government assuming other EV models not included in the current list would be eligible (e.g. Kia Niro and Hyundai Ioniq 5).

[4] Corporate fleets make up half of all new car purchases and currently have an important role to play in nudging the market towards larger, less environmentally friendly vehicles.