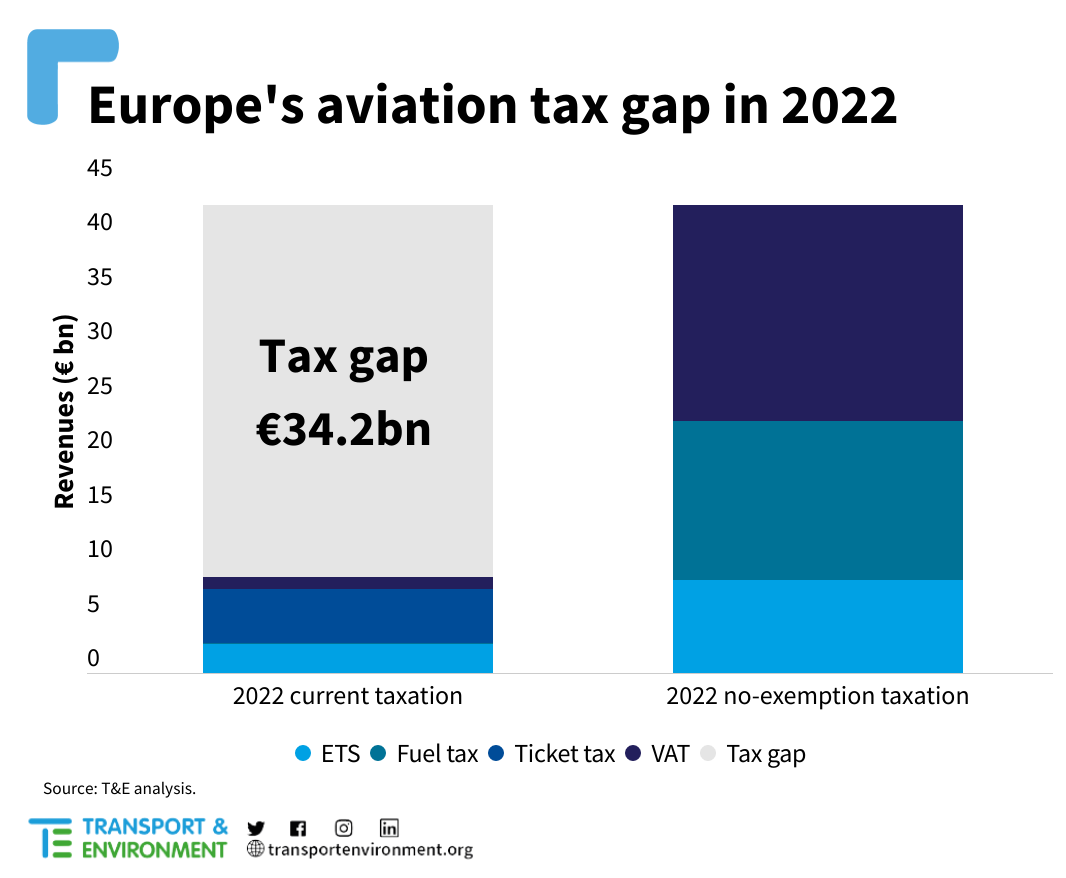

European governments lost out on €34.2 billion in revenue last year due to very low levels of taxation in the aviation sector, a new study by green group Transport & Environment finds. This €34.2 billion could pay for 1,400 km of high-speed rail infrastructure – equivalent to the distance from Hamburg to Rome[1].

The analysis looks at the revenues that should have been raised from air travel pricing if the sector did not benefit from exemptions. It compares these revenues with those that were actually raised in a year. This is defined as the ‘tax gap’. The sector pays no kerosene taxation, little to no ticket taxes or VAT and a carbon price on intra-European flights only.

The UK and French governments would have cashed in an extra €5.5 and €4.7 billion if aviation was taxed adequately. The four European countries where the tax gaps are the largest are the UK, France, Spain and Germany, mainly reflecting the size of their aviation sectors. Although France, Germany and the UK levy a ticket tax, their low levels of ticket taxation aren’t able to fill the gap.

Air France and Lufthansa are the two biggest contributors to the tax gap in Europe, due to the size of their activity. Europe lost out on €2.4 and €2.3 billion of revenue from these airlines’ activities. The study differentiates between charges on passengers and on airlines. Ticket taxes and VAT are imposed on passengers, whereas fuel taxes and carbon pricing are directly attributable to airlines. Of the €34.2 billion gap, €20.5 billion should have been paid by carriers in fuel taxes and carbon pricing.

Jo Dardenne, aviation director at T&E, explains: “Europe is bleeding money by not taxing the aviation sector. Airlines are edging close to record profits this year, whilst spewing dirty fuels in our skies. But governments are unwilling to touch their precious national carriers. How can they justify to citizens that drivers pay more taxes than Air France and Lufthansa for their fuel?”

Unless action is taken, the tax gap will increase by 38% by 2025, as the sector is set to grow in coming years. Eurocontrol estimates that traffic will reach 92% of pre-COVID levels in 2023 and a full recovery by 2025. By then, the tax gap could grow to €47.1 billion, T&E finds.

Closing the gap and addressing aviation’s under-taxation should be an utmost priority for governments. The study recommends applying a fuel tax on kerosene, a 20% VAT rate on tickets and extending the carbon market for aviation to all departing flights. These changes would help to close the gap in government budgets. In the absence of these measures, T&E recommends applying a ticket tax equivalent to the gap in each country.

The study shows that higher taxes will have an impact on passenger ticket prices. This could result in a decrease in demand and CO2 emissions savings. The study finds that ending exemptions in 2022 would have saved 35 Mt of CO2, with an even higher total climate impact accounting for non-CO2 effects of aviation. As the sector seeks to decarbonise, revenues raised by taxation should be partly reinvested in green technologies, including e-kerosene.

Jo Dardenne concludes: “Taxation should not be perceived as a punishment but as a way to fairly charge those who benefit most from aviation’s under-regulation. Those better off in society have been paying far too little for their flying habits. On top of that, taxation will not limit aviation’s capacity to invest. On the contrary, taxing aviation will benefit citizens and the sector in the long run, as governments step in to finance the transition to clean energy, including for aviation. It’s time to end the era of cheap flying and the growth in emissions.”

[1] According to the European Court of Auditors report, Building a HSR line in the EU costs on average 25 million per km. We calculated that 1368 km of tracks could be built with a total amount of €34.2 billion. It would cover the distance between Hamburg – Rome (1309 km).