When it comes to critical minerals, Europe faces a triple challenge of onshoring supply, securing diverse global markets and doing all this sustainably. As the demand for minerals such as copper and lithium used in green technologies is expected to quadruple by 2040, the EU will remain dependent on the import of raw materials from third countries for a long time. Research shows that even if Europe fully maximises its mineral extraction, refining and recycling capabilities by 2030, more than half of critical minerals still need to come from abroad. So the challenge is to source these metals resiliently – i.e. from diverse markets – and responsible, i.e. with high social and environmental standards at the core. That’s where Europe’s new framework of “strategic partnerships” comes in. In this paper T&E analyses the progress to date and looks at what Europe needs to do to succeed.

The key challenge today is the supply of critical raw materials (CRM) from third countries is strikingly concentrated. For instance, China remains the sole supplier of processed rare earth elements to the EU, accounting for 85%-100% as of 2023. Chile is responsible for 79% of Europe’s lithium supply, while the Democratic Republic of Congo provides 63% of cobalt globally. Crucially, the vast majority of all these minerals are processed in China, which has a near monopoly in the midstream of the supply chain. The emergence of resource nationalism and export restrictions in countries such as Indonesia, China, Chile, Namibia, and Zimbabwe is another major challenge, as resource-rich nations seek to build their own minerals processing and clean tech manufacturing as they engage with external partners like the EU.

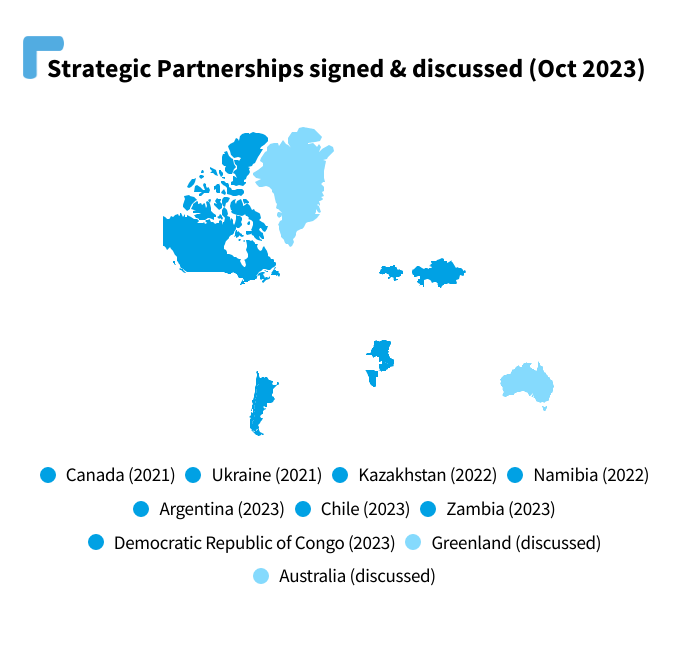

To diversify the EU’s supply of critical raw materials, the EU has begun using the instrument of Strategic Partnerships to enhance cooperation with third countries. In 2021, the EU signed Memoranda of Understanding (MoUs) for a Strategic Partnership with Canada and Ukraine. In 2022, similar agreements were established with Namibia and Kazakhstan, followed by additional partnerships in 2023 with Argentina, Chile, Zambia, and the Democratic Republic of Congo. These MoUs are designed to integrate raw material value chains, identify collaborative projects, and advance research and development while upholding rigorous environmental, social, and governance (ESG) standards. This approach helps the EU secure its supply chain and simultaneously addresses its domestic needs and interests, promoting economic development in resource-rich countries.

But the challenge for Europe to catch up is huge. China has invested €15 billion in global minerals projects in the last few years alone. So as the EU scales its strategic partnerships, it needs to act quickly and adapt its approach to resource-rich countries to build up its unique selling point (USP). To secure Europe’s critical minerals supply, the EU should support resource-rich countries’ green industry plans, focusing on technology transfer, skills and responsible mining and processing practices. . The approach via Strategic Partnerships can be a promising way forward if accompanied by concrete projects and investments. In this regard, what’s missing is quick and long-term downstream business engagement from western car and battery makers, as well as the metals industry.

To make these partnerships a success, the EU should:

- Cultivate more Strategic Partnerships, with a diverse set of partner countries and clear prioritisation of the critical minerals needed: alongside high social and environmental criteria, laser sharp focus is needed. E.g. Europe will need a lot more battery metals than green hydrogen in the next decade.

- Foster local green industrial value chains and responsible sourcing practices in resource-rich countries: this includes developing processing and manufacturing activities, genuine technology transfer, local labour force upskilling, as well as capacity building activities.

- Establish a robust funding framework, including fresh money via the Global Gateway initiative and a dedicated CRM fund: The EU should financially support these initiatives through guarantees, grants and loans, making projects abroad not only attractive but also economically viable and scalable. A dedicated fund is needed to de-risk projects and build technical and regulatory capacity in strategic partnership countries.

- Bring EU companies on board: having Europe’s cleantech companies on board with long-term offtake agreements, as well as support with technology and skills expertise, is paramount to the success of strategic partnerships.

Overall, addressing the north-south divide and securing sustainable mineral supply chains requires a global perspective, with many like-minded partners on board. This involves harmonising standards, ensuring their enforceability and working jointly to avoid fragmentation of initiatives.