Image: Go Ultra Low

Interested in this kind of news?

Receive them directly in your inbox. Delivered once a week.

Carmakers will bring to market 92 fully electric models and 118 plug-in hybrid models in 2021, which they need to sell to meet the EU car CO2 target of 95g/km. If the forecast plans are delivered, by 2025 22% of vehicles produced could have a plug – more than enough to meet the EU’s car CO2 standard for that same year. Meanwhile, the production plans for other alternative drivetrains are almost non-existent: only 9,000 fuel cell cars in total are forecast to be produced by 2025 compared to 4 million electric cars. The production of compressed natural gas cars is even set to decrease, accounting for fewer than 1% of vehicles produced in Europe by the mid-2020s.

Lucien Mathieu, transport and emobility analyst at T&E, said: “Thanks to the EU car CO2 standards, Europe is about to see a wave of new, longer range, and more affordable electric cars hit the market. That is good news but the job is not yet done. We need governments to help roll out EV charging at home and at work, and we need changes to car taxation to make electric cars even more attractive than polluting diesels, petrols or poor plug-in hybrid vehicles.”

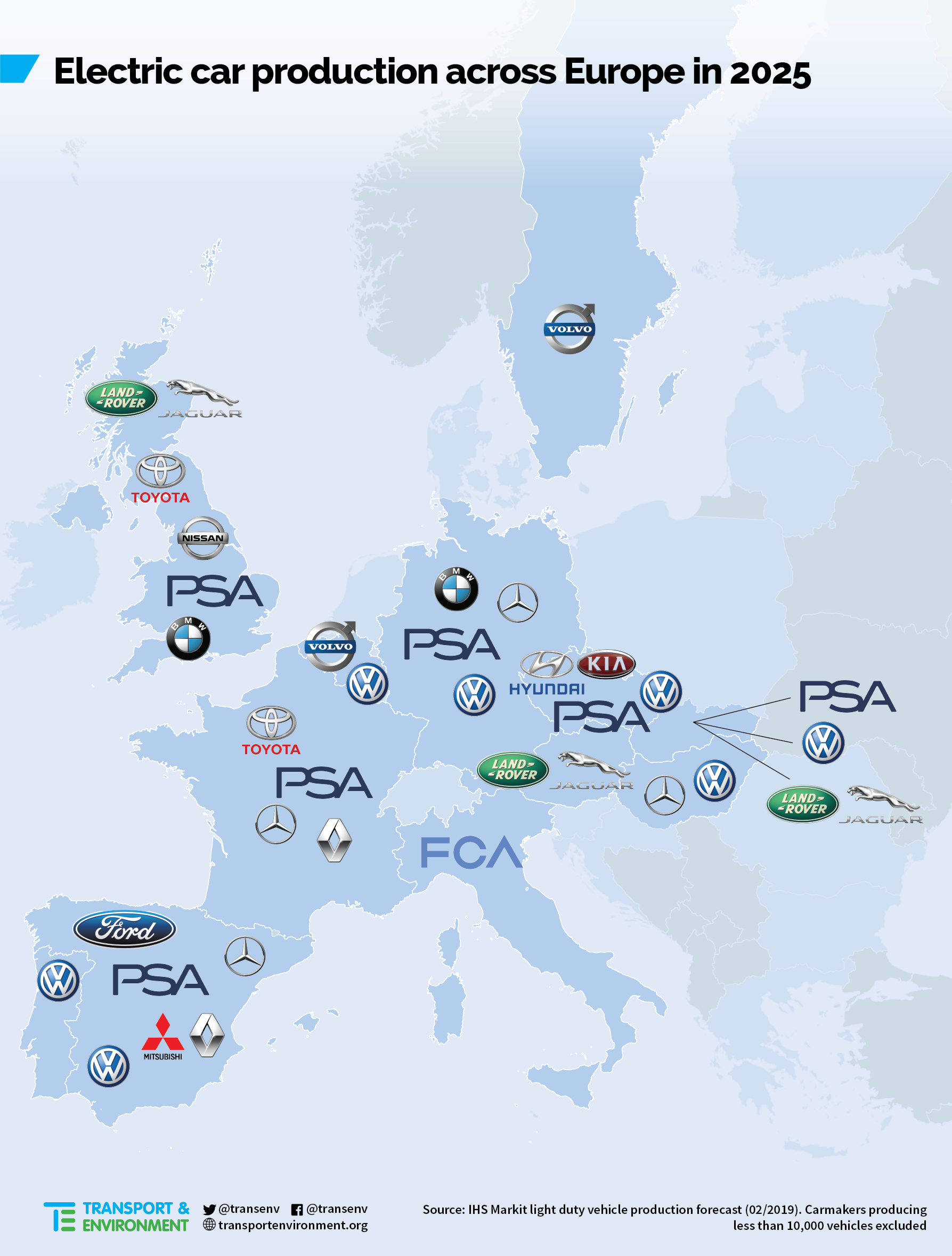

The production forecasts show electric car manufacturing steadily replacing diesel engine manufacturing across Europe, with the biggest production centres set to be in western Europe – Germany, France, Spain and Italy. But Slovakia is forecast to be making the highest number of EVs per capita by 2025. Czech Republic and Hungary will also be significant production centres. The UK remains uncertain as the forecasted EV production growth could easily be reversed in the case of a ‘no deal’ Brexit.

Already, 16 large-scale lithium-ion battery cell plants are confirmed or likely to come online in Europe by 2023. The confirmed plans alone will deliver up to 131 GWh of battery production capacity, according to data from Benchmark Mineral Intelligence – enough to cover the estimated 130 GWh that will be needed by EVs and stationary storage batteries across Europe in 2023. Based on data from the EU’s Joint Research Centre, battery manufacturing on this scale will create around 120,000 jobs directly and indirectly in the battery value chain. But T&E said the EU will also need to ensure batteries sold in Europe have a low carbon footprint and are reused, recycled and sourced ethically.

Lucien Mathieu concluded: “This is a pivotal moment for Europe’s automotive industry. Carmakers are investing €145 billion in electrification, and battery making is finally coming to Europe. Success in this area is a top EU industrial priority. We need to send a clear signal to industry that there is no way back, and agree a phase-out of petrol and diesel car sales in cities, at national and EU level. The age of the combustion engine is coming to an end.”

Read more:

Electric surge: Carmakers’ electric car plans across Europe 2019-2025