Interested in this kind of news?

Receive them directly in your inbox. Delivered once a week.

Company cars have for years been associated with incentivising motoring, with some early schemes offering the highest tax exemptions for the greatest distances driven. Many of those schemes have now been changed, but company car regimes have yet to catch up with the need to fight climate change and the growth in availability of electric vehicles. With 60% of new cars sold to companies, the second-hand car market is heavily influenced by company car regulations.

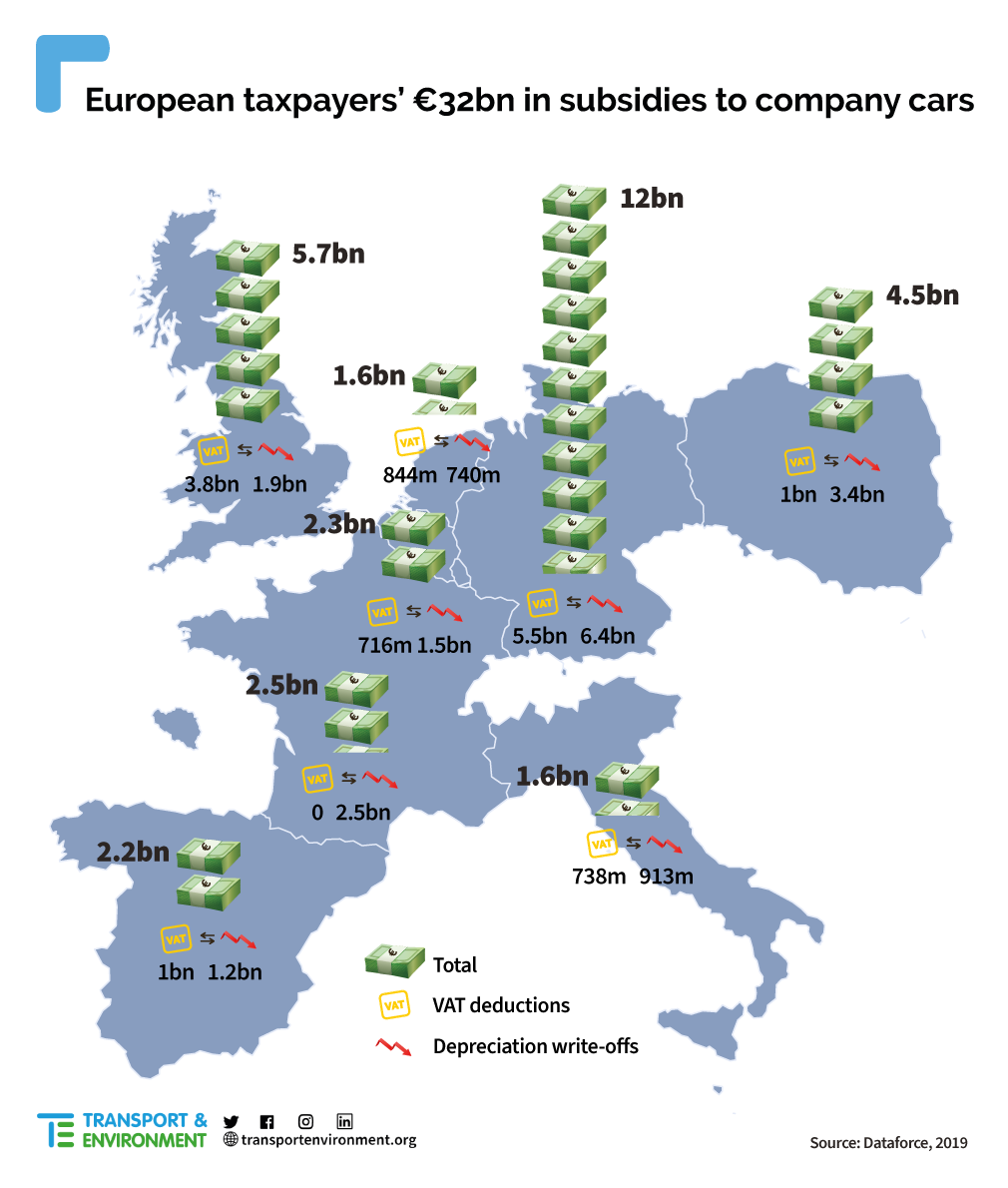

Nearly all (96%) new company car registrations last year were petrol and diesel, according to the study for T&E by the German automotive fleet research agency Dataforce. Yet a mixture of value-added tax deductions and depreciation write-offs means that €32 billion in public money is used to subsidise these car sales, in effect getting taxpayers to fund pollution.

T&E says the conclusion from this analysis is that any favourable tax treatment for company cars must be linked to a rapid conversion of the fleet to zero-emission vehicles, which means electric purchases only by the middle of this decade. T&E’s e-mobility manager Saul Lopez said: ‘The current situation is madness, not just because taxpayers shouldn’t be subsidising pollution and climate change, but because e-vehicles are cheaper to run. Electrifying the company car sector is low hanging fruit for countries to make progress towards their national climate goals, so governments, the EU and cities should pick this low-hanging fruit and insist that all new company cars are electric by 2025.’

The new seven-party coalition government in Belgium has, as part of its programme, a plan to ban new company cars with engines from 2026. The commitment is to make tax breaks apply only to carbon-neutral cars, which would include a ban on plug-in hybrids and mean only battery electric vehicles would qualify. Around 10% of Belgium’s 6 million cars are company cars, and surveys suggest they are driven greater distances than private cars.

Lopez added: ‘We fully support what the Belgian coalition is committed to doing. Belgium has a fairly generous company car tax regime, so this denotes a shift in culture which we hope the government will carry out and other EU member states will follow. The result will be a dramatic shift in the car market towards electric, and this in turn will make more of them available second-hand.’

The countries with the biggest tax subsidies for company cars are Germany with €12 billion, Poland with €4.5 billion and the United Kingdom with €5.7 billion. The 10 largest leasing companies – which include BMW’s Alphabet and Daimler’s Athlon – cause 8% of EU car CO2 emissions because their cars are driven more than twice the distance as private cars.