Interested in this kind of news?

Receive them directly in your inbox. Delivered once a week.

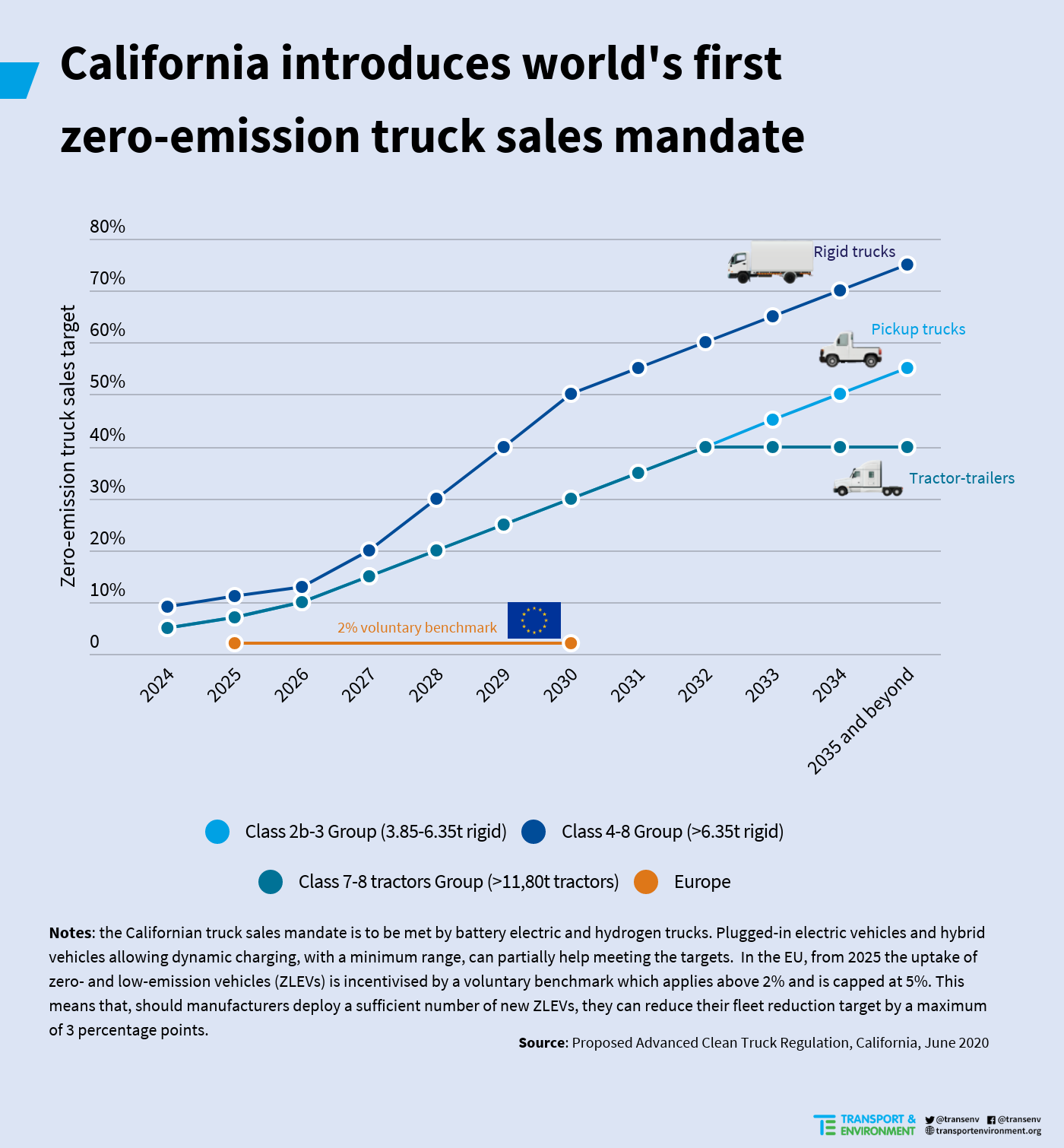

By 2024, between 5% and 9% (depending on the weight category) of new trucks sold in California must be emissions-free. Up to half (30-50%) of sales must be zero-emission by 2030 and all of them by 2045. Meanwhile in Europe there is only a voluntary 2% sales benchmark for zero and low emissions trucks, with no penalties if it is not reached. Last year a broad coalition of companies, including Nestlé, ABInBev and Unilever, asked the European Commission to set an ambitious mandatory sales target for emissions-free trucks – having expressed clear concern over the lack of supply of clean vehicles.

Pauline Fournols, clean freight policy officer at T&E, said: “Europe is waking up to the news that the days of fossil fuel trucks in California are over. What truckmakers can do on the other side of the pond, they can also do here. The EU needs to catch up urgently by announcing a binding sales target when it reviews the truck CO2 law in 2022 and the 2030 climate targets.”

In their national recovery plans – which they will submit to the European Commission from this autumn – EU governments should promote emissions-free trucks and infrastructure only and announce phase-out dates for fossil fuel truck sales.

Note to editors:

[1] Market Share of tractor lorry manufacturers in the EU: